ArcelorMittal CLN Distribuzione Italia Acquires Ciocca Lamiere

The acquisition of the service center of Arcore is announced today

Caselette, March 31st 2016 – ArcelorMittal CLN Distribuzione Italia srl (ArcelorMittal CLN), one year after its establishment, has announced today the acquisition of 100% of the Ciocca Lamiere S.r.l. company with headquarters in Via Buonarroti 80/88, 20043 Arcore (MB), Italy.

Ciocca Lamiere is a service center for the pre-processing of coils, which began its business in 1960, located in the industrial area of Arcore (Italy), on an area of about 20,000 sqm. The plant is logistically positioned in one of the industrial areas where consumption is highest, with the advantage of being close to major highways and railway junctions as well.

The company processes steels with low carbon content, both hot rolled pickled, and cold-rolled and coated (galvanized, electrogalvanized, aluminized, prepainted), turning them into sheets, tapes, strips and squares.

Through this transaction, ArcelorMittal CLN has acquired the Ciocca Lamiere business branch, production assets and the marketing placement, with exception to the grounds, which will remain of the Ciocca Family.

Ciocca Lamiere’s current turnover is approximately 50,000 tons/year, stretching across the general industry sector. With the entry of ArcelorMittal CLN in its network and thanks to the proximity to the production site in Monza, such acquisition will enable to develop further and important synergies and offer an ever-higher service to its customers.

According to Michele Ciocca, shareholder and CEO of Ciocca Lamiere, “to become part of such an important organization, makes it possible to give continuity, on the one hand, at the historical presence of the family company on the market, and to be able to count on greater resources for the company’s subsequent potential development.”

“Along with such drive, our leadership strengthens on the domestic distribution market” – said Rinaldo Baldi, new CEO of ArcelorMittal CLN -, “in view of the current process of consolidation to win and assure ourselves a better presence on the market.”

EUROMETAL Regional Meeting Central Europe, Prague 19 April 2016

Dear Steel Stakeholders,

EUROMETAL Regional Meeting Central Europe is coming closer.

Do not miss a unique opportunity to meet and discuss with colleagues, speakers and panelists about the challenges ahead of Central and Eastern European Steel Markets.

For this important conference, EUROMETAL was able to gather an expert and competent set of speakers and panelists representing all echelons of the steel supply chain.

EUROMETAL is convinced that this conference will bring a lot of added value to all participants.

Below you may find your invitation letter, including your registration form, as well as the flyer with the program of the event.

EUROMETAL REGIONAL MEETING CENTRAL EUROPE PRAGUE 19 APRIL 2016 – INVITATION LETTER

EUROMETAL REGIONAL MEETING CENTRAL EUROPE PRAGUE 19 APRIL 2016 – CONFERENCE FLYER AND PROGRAM

Hoping to meet you in Prague on 19.April 2016.

Georges Kirps

Director General EUROMETAL

BDS and EUROMETAL at CRU World Steel Conference

BDS and EUROMETAL participated at CRU World Steel Conference in Düsseldorf, last 18. March 2016.

This conference is attended mainly by upstream steel industry stakeholders.

Thus, the conference represented a unique opportunity to outline the systemic role of steel distribution as an intelligent matchmaker between upstream steel producing sector and downstream steel end use segments.

In their respective presentations, Oliver Ellermann, Managing Director of BDS, and Georges Kirps, Director General EUROMETAL passed the following key messages to the participants at CRU World Steel Conference:

- EU Steel Distribution accounts for 5 000 companies, mostly SMEs.

- Giving jobs to a workforce of 110 000 people

- Delivering 77 million tons of steel

- To a EU customer base of 1 million steel end users.

Due to the diversity of their customer base, steel distribution has developed a great variety of business models.

Long steel products, tubular products and stainless steels are predominantly procured by steel end use segments from EU steel distribution.

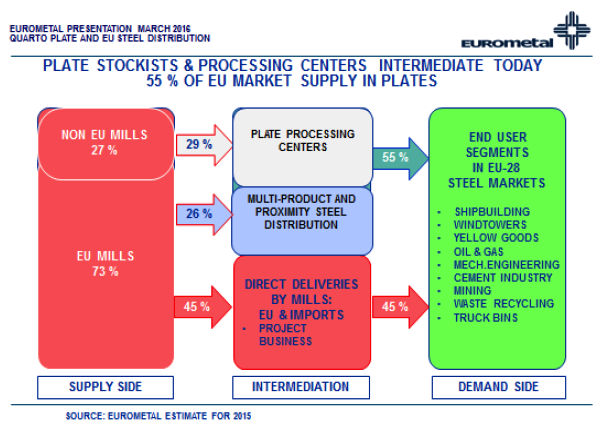

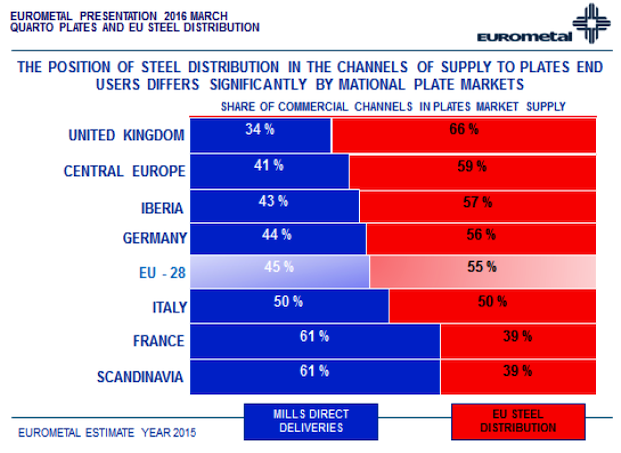

Only in the channels to the market of plates and strip mill products, direct procurement from the mills plays a significant role, besides steel distribution flat SSC and processing centers

As opposed to US steel distribution, EU steel distribution is characterized by a significant share of mill tied steel distribution companies.

Over-capacities will further prevail in steel distribution, calling for consolidation, acquisitions and mergers in order to streamline and optimize steel distribution’s offer to their customer base.

Linking with mills or mill-tied SSC has shown in the past years to be a rather frequently used avenue for consolidation in EU SSC distribution.

But also Chinese and Russian steel producers made efforts over past years to gain footprints in EU steel distribution and trading.

Einladung zum World Café: Digitale (Alp-)Träume, 14. April 2016 in Aarau

Die Digitalisierung ist für die einen Handelsunternehmen ein Traum, für die anderen wird die Entwicklung zum Alptraum. In welche Richtung träumen oder handeln Sie? Das World Café bietet Orientierungshilfen.

Sie erfahren, was den Online-Handel international antreibt und welche Risiken sich für den Schweizer Handel ergeben. Sie finden heraus, was Schweizer KonsumentInnen online im Ausland kaufen. Von Darknet über Hacking bis zu digitalen Handelslösungen – Sie machen sich schlau punkto Datensicherheit. Sie diskutieren, wohin die Digitalisierung den Handel treibt. Tauschen Sie sich mit Handelsunternehmern, Politikern, Medien und Konsumenten aus.

Lassen Sie sich inspirieren und nehmen Sie brandaktuelles Wissen mit nach Hause. Es hilft Ihnen, ihre digitalen Wunschträume sofort rascher richtig umzusetzen!

EUROMETAL at Steel Plate Conference Europe by Metal Expert

EUROMETAL participated last March 11 in the 2nd Steel Plate Conference Europe, convened in Düsseldorf by Metal Expert.

One of the speakers of the conference was Georges Kirps, Director General EUROMETAL, with a presentation on the Systemic Role of Steel Distribution in EU Plate Supply.

World plate market is estimated to about 130 million tons.

Theoretical world plate capacity is about 210 million tons, meaning a capacity utilization rate of about 60%.

World plate market is estimated to increase to 185 million tons in 2024.

EU plate market accessible to steel distribution is presently 9.6 million tons.

European plate market is estimated to grow between 2014 and 2024 by a CAGR of +1,7 %.

Long term growth forecasts of European plate using sectors:

– Construction: + 0,5 %

– Line Pipe: 0,0 %

– Shipyards + 1,1 %

– Wind Energy Onshore: + 5,0 %

– Wind Energy Offshore: + 8,0 %

– Mechanical Engineering: + 3,0 %

– Oil & Gas Short term: ?

– Oil & Gas Long term: positive

In Europe, capacity utilization is running at 53%.

In 2015 and for the first time since long, Europe has become a net importer of plates.

Here are the two key charts of the EUROMETAL presentation:

Invitation to the EUROMETAL Regional Meeting Central Europe 2016 in Prague

After a great success last year in Vienna, EUROMETAL will convene again a EUROMETAL Regional Meeting Central Europe, this time in Prague, on coming 19 April 2016.

In last 20 years Central European steel markets have developed their own specific business models based on dynamic growth patterns.

Will these positive trends continue in coming years or are there now signs of structural changes leading to a rethinking of future Central and Eastern European steel business models.

EUROMETAL Regional Meeting Central Europe is intended to address these and other crucial questions and challenges.

In the attachment you may find your invitation to register to this important steel business meeting, in Prague on 19.April, having focus on Central Europe

Please note that EUROMETAL invites all participants to a welcome buffet at the meeting hotel HILTON Old Town in the evening of 18 April, from 19.30 Hrs on.

Hoping to greet and meet you in Prague on coming 18.- 19. April 2016.

Best regards,

Georges Kirps – Director General EUROMETAL

EUROMETAL REGIONAL MEETING CENTRAL EUROPE PRAGUE 19 APRIL 2016 – INVITATION LETTER

EUROMETAL REGIONAL MEETING CENTRAL EUROPE PRAGUE 19 APRIL 2016 – CONFERENCE FLYER & PROGRAM

EUROMETAL – European Steel Distribution to enhance health and safety skills

In steel distribution dominated by cost cutting and scarce resources, allocation of resources to improve Health & Safety is too often still considered as non-essential expenses by some steel distribution companies

On the other side in case of a fatality, the civil responsibility of the management is evident.

Insurance claims related to accidents or fatalities often prove to become very expensive, outnumbering by far the cost of a comprehensive and efficient action plan to prevent accidents

Too often, smaller companies are reluctant to comply with Health & Safety essentials.

A specific concern for EUROMETAL and national federations are behavioural safety and Near Miss Reporting in steel distribution. EUROMETAL and national steel federations will use best efforts to enhance behavioural safety inside European steel distribution.

Main actions will include a permanent update on Health & Safety issues on the websites of EUROMETAL and of national federations, seminars regarding Health & Safety, also specifically designed for SME’s, presentations at EUROMETAL’s major events regarding latest developments in Health and Safety issues.

Commenting Health and Safety issues in steel distribution and SSC, Peter Corfield, Director General of UK Association NASS, outlined:

“…safety within the Steel supply chain has evolved within the last decade paving way for not only a considered approach to Safety but now also contemplation of Health and general wellbeing of the workforce. Near Miss reporting and Behavioural Safety is evidence of maturing safety models within the industry with aspirations for continuous improvement, looking at both the impact of cognitive interaction and the likely consequences for disregarding early warning signs.

New challenges face Metals Industries going forward with economic climates dictating long working hours, pressure on production times and elevated levels of stress amongst the workforce.

With increasing burden on employees to meet deadlines, the probability to “cut corners” during safety procedures has increased. Accident statistics benchmarked by Metals Forum Members in the UK have highlighted concern for protecting employees from hazardous machinery and dangerous equipment which have attributed to a rise in injuries since 2009, in turn increasing claims against the Employer.

In light of recent changes to UK legislation regarding sentencing which has now extended liability for Business owners and Senior Managers as well as increased penalties for breaches of Health and Safety, there is now even more onus on Management to protect their employees from foreseeable harm. This, in line with expected changes to be brought about by ISO 45001 in October 2016 whereby management must demonstrate a clear commitment to driving improvements in Health and Safety performance will further increase onus on leadership of Health and Safety throughout the organization.

In order for business leaders to demonstrate this commitment, plans must be in place to integrate not only with the internal workforce but with external bodies including the supply chain, key stakeholders, safety enforcement bodies and peer groups”.

Contact: Georges Kirps, Director General

Email: kirps@eurometal.net

Central Europe only EU area with output growth

Central Europe was the only EU region with a positive growth rate for steel output in 2015. Steel production in the region showed a 4% increase on 2014, compared with 2% decline in western Europe, a 3% decline in southern Europe and 6% decline in the Black Sea and Balkan countries, trade group EUROMETAL said ahead of its regional meeting on central Europe scheduled for April 19 in Prague.

Central Europe also showed positive performance in steel consumption. Apparent consumption increased in all countries in the region with Poland’s steel consumption for last year estimated at 12.6 million, 2% up on 2014 and 24% up on 2009, Platts learnt.

Owing to its positive fundamentals central EU markets have been strongly penetrated by western European distributors, which have been challenging local independent players such as Ferona, Konsorcjum Stali, Bowim and Raven, according EUROMETAL’s research.

The downstream steel sector in Europe continues to integrate as central European steel markets are gradually becoming part of multilateral industrial and commercial networks, EUROMETAL noted.

Also, despite Klöckner and Tata Steel Distribution pulling out of central Europe, many players based in the western part of the EU, including Salzgitter Handel, ThyssenKrupp Materials, BE Group, ArcelorMittal Distribution and Jacquet Metals have retained their foothold in the central European markets.

Wojtek Laskowski, PLATTS

Concourez pour les Trophées Eiffel 2016

Après le succès des premiers Trophées Eiffel d’architecture acier organisés en 2015, ConstruirAcier lance la deuxième édition de ce concours qui s’impose déjà comme le grand rendez-vous de l’architecture métallique. Les trophées Eiffel d’architecture acier visent à distinguer des œuvres architecturales variées et significatives, réalisées tout ou partie grâce au matériau acier. Concepteurs, architectes, ingénieurs et entreprises de construction métallique… vous avez jusqu’au 29 avril 2016 pour déposer votre dossier de candidature sur le site des Trophées Eiffel

Qui peut participer ?

· Projet implanté sur le territoire français

· Réalisation livrée entre le 1er janvier 2014 et le 31 décembre 2015 et n’ayant pas été déjà candidat à l’édition 2015

· Ouvrage construit tout ou partie avec de l’acier dans toutes ses formes d’utilisation : structure, enveloppe ou second-œuvre.

Comment participer ?

· 6 catégories : FRANCHIR / HABITER / TRAVAILLER / APPRENDRE / DIVERTIR / VOYAGER

· Dépôt du dossier à l’initiative d’un des acteurs du projet : architecte, BE, entreprise, maître d’ouvrage…

· Fiche d’inscription à télécharger sur ici

Quand participer ?

· 29 avril 2015 minuit : date limite de dépôt des dossiers

· septembre 2016 : examen des projets par le jury

· début octobre 2016 : remise des prix à Paris lors de la soirée Steel.in

Le jury est composé d’architectes, ingénieurs, journalistes spécialisés en architecture et industriels de la filière Acier, reconnus pour la qualité de leurs travaux dans le monde de l’architecture, de la construction acier et de la métallerie.

Les œuvres sont jugées sur leurs qualités architecturales et constructives alliées à la mise en valeur du matériau acier.

Pour découvrir les projets lauréats 2015 et vous inscrire pour l’édition 2016, rendez-vous sur le site dédié des Trophées Eiffel

Spring has sprung in the steel markets: analysis

Raw material and finished steel prices continued to firm last week, with improving sentiment in the iron ore market feeding confidence into steel markets and vice versa. The trap of low demand preventing prices increasing for a sustained period of time appears to have been shut for now as rhetoric over production cuts finally appears to be realized.

The benchmark Platts IODEX assessment had iron ore ticking up closer to the $50/dry metric ton mark last week although the pace of increase had slowed. Steel mill margins benefitted as the spread between the iron ore price and the domestic Chinese HRC level rose by $5/mt week-on-week, while the Platts China long steel spread suggests rebar producers’ margins were $181/mt as of February 29. This was up markedly from the low point of $147/mt as of December 7.

The strengthening domestic Chinese market has allowed steel producers to focus their attention on selling locally rather than exporting. This decline in supply meant the Platts East Asian CFR HRC assessment rose $10.50/mt week-on-week to $298-303/mt.

Last year much of the world’s pricing for hot rolled coil fell in line with an FOB China price plus freight. This increase in export prices has helped mills in other regions to push prices as was seen in the $12.50/mt increase in the FOB Black Sea market and even a €5/mt rise in the domestic north European Platts assessment.

Europe has been increasingly exposed to imports, with China, Russia, Iran, Brazil, South Korea and more recently India increasing their presence in the trade statistics. The firming of the Chinese offers following the Lunar New Year holiday reinforced the confidence of domestic steelmakers to push for higher levels. Similarly, in the US the trade measures brought in to limit the competition from external sources continued to support mills as the ex-works Indiana cold rolled coil assessment gained $10/short ton.

On the other hand, the outlook looks much weaker in the Brazilian market where the macroeconomic picture is weighing on demand for steel. The construction sector is particularly weak and prices of products such as rebar are falling amid the competition for orders. On the flats side, the financial difficulties at Usiminas saw it withdraw offers to Europe following the carnival period, instantly removing one of the previously most competitive players for cold rolled coil and EZ. This built upon the trade actions in the US which cut off one of the most significant markets for the Brazilian producers.

The international scrap market has bounced even higher than iron ore as a glut of buying in India spooked the Turkish mills into accepting higher prices for cargoes. This sentiment carried on as the return of spring and construction activity boosted domestic demand at a time when exporting is increasingly difficult.

This market analysis report was taken from the March 2 edition of Platts World Steel Review.

Peter Brennan, PLATTS