Turkish mills continue to pull down domestic scrap buying prices

Turkish steel mills continued to cut their lira-denominated domestic scrap buying prices for the third consecutive day on Dec. 24, as the currency continued to strengthen after the government announced support measures Dec. 20.

Turkish deepsea import ferrous scrap prices inched up on Dec. 23, as a fresh Venezuela-origin cargo was booked. S&P Global Platts assessed Turkish imports of premium heavy melting scrap 1/2 (80:20) Dec. 23 at $461/mt CFR, up $1/mt on the day. The index has fluctuated in a $460-$465/mt CFR range since Dec. 15.

Colakoglu, one of Turkey’s largest EAF-based steelmakers, cut its domestic buying price again for DKP grade (auto bundle) scrap in this sentiment to Lira 6,055/mt ($510) on Dec. 24, while the company’s extra grade domestic scrap buying price fell by the same amount to Lira 5,580/mt ($470/mt). The exchange rate was Lira 11.9/$1 on Dec. 24 at 12 pm Turkey Time.

The DKP scrap buying price for one of Turkey’s largest alloy steel producers, Asil Celik, was set at Lira 5,965/mt ($502/mt), while the company’s extra grade domestic scrap buying price fell to Lira 5,200/mt ($438/mt).

Kardemir, Turkey’s integrated long steelmaker pulled down its extra grade domestic scrap buying price to Lira 6,115/mt ($516/mt) on Dec. 24. The Eregli mill of Erdemir Group, Turkey’s largest integrated steelmaker, also cut its DKP domestic scrap price to Lira 5,835/mt ($493/mt), while its extra-grade scrap buying price declined to Lira 5,830 ($492/mt), according to the mill’s updated domestic scrap buying price lists seen by S&P Global Platts.

Turkish mills use 30 million mt of steel scrap per year and have been procuring about a quarter of it from the domestic market.

— Cenk Can

Kallanish Steel: 2021, a year like no other

2021 was a year like no other. Amid the rapid global spread of Covid-19 in 2020, the lockdowns that followed and the fear and uncertainty that gripped the world, few would have imagined that economic activity would rebound with so much force, so rapidly. Mankind developed vaccines and quickly adapted to life with the virus, but, after significantly scaling back operations in the first half of 2020, industry struggled to ramp up supply to match the demand boom that came next.

The year was one of two halves.

The first was dominated by the shortfall in supply, which sent steel prices spiralling globally. China, whose demand had single-handedly propped up the steel market for much of 2020, saw crude steel production rising rapidly despite attempts to curb it, while end-user demand, more importantly, soared even higher. Gone was the earlier notion that Chinese demand would stabilise at lower levels amid the country’s shift to consumption-led growth. This was coupled with still limited Chinese steel exports, as the government cancelled export tax rebates on most steel products in May.

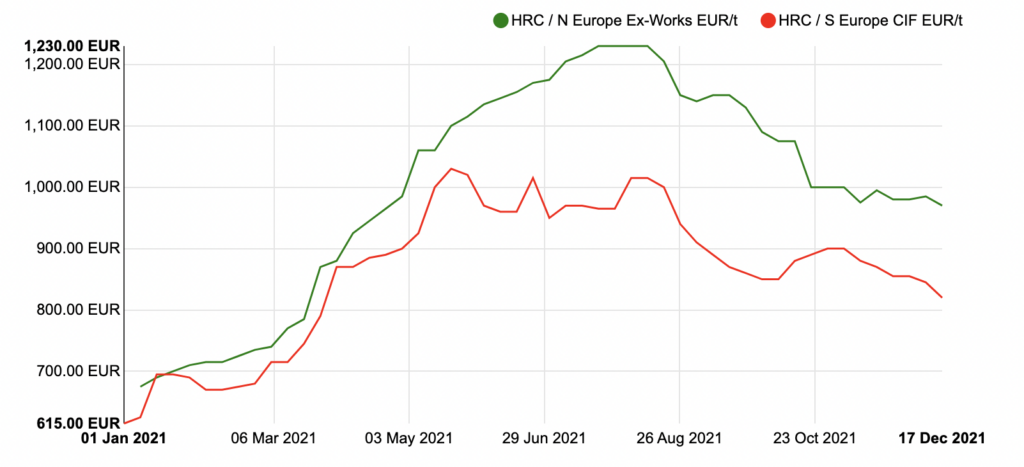

European hot rolled coil prices in April meanwhile reached the previously mythical level of €1,000/tonne as mills struggled to meet demand, hiking prices on a weekly basis. This was despite semiconductor shortages forcing increasingly more carmakers to curb production and therefore not take up the procurement of automotive steel stipulated in their annual contracts.

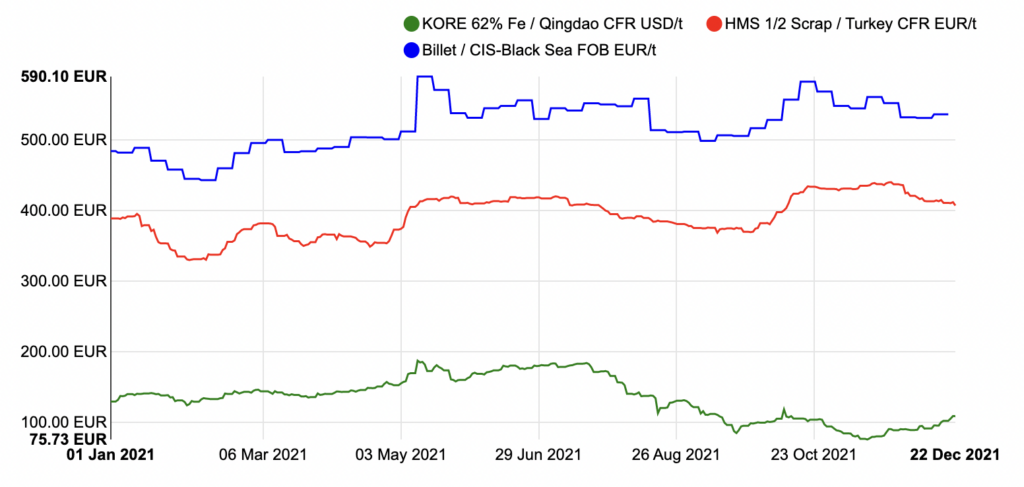

May was a month for record prices, with the KORE 62% Fe index surging to an all-time high of $226.07/tonne cfr China on 10 May, driven by speculation, before China’s government intervened to cool the market. HMS 1&2 80:20 scrap surpassed $500/t cfr Turkey on 11 May for the first time in ten years, later peaking at $512.5/t. CIS billet surged to $715/t fob Black Sea on 10 May.

The headlines that month were dominated by expectations China would implement an export tax on HRC, as part of its push to limit exports to high value-added products. To this day, however, no tax has been implemented, and it looks increasingly unlikely that this will happen.

Given the supply shortages gripping Europe, many expected the European Commission to revoke or relax safeguard measures at the end of their three-year tenure in June. However, much to the delight of EU steelmakers and the dismay of end users, duties were extended for another three years. The swearing in of Joe Biden as US President in January, meanwhile, did nothing to change Section 232 measures, convincing steel market participants that protectionism was here to stay.

See the latest safeguard measures

Summer was a turning point, as China implemented environmental restrictions to curb steel production, ordering steelmakers to ensure 2021 production remains at or below 2020 levels. The KORE 62% Fe index slipped below $200/t at the end of July and has not returned to this level since. A new surge in Covid-19 cases in Asia, meanwhile, slashed rebar demand on the continent and kept Turkish mills out of the market in August, hampering scrap price growth.

Rather than the typical post-summer steel demand rebound, global markets remained subdued in September, as soaring input costs began to seriously pressure the margins of steelmakers in regions such as Europe and Turkey, with some mills announcing they would need to curb production due to costlier energy, while others implemented energy surcharges. Moreover, concerns over the collapse of Evergrande and a resulting debt contagion stifled China’s real estate market. (Read related article here)

There was brief hope that demand would rebound after China’s Golden Week holiday in October, but this never materialised. Instead, Chinese prices began to collapse on weak Chinese steel demand, real estate activity and fixed asset investment. KORE 62% Fe fell to $86.79/t on 15 November – the lowest level since May 2020.

At the end of October, the US and EU signed a new trade deal to allow over 4 million tonnes/year of EU steel to enter the US duty free. This sent other US allies, such as Japan, Korea and the UK, scrambling to negotiate similar agreements with the world’s largest economy. Premium coking coal prices, meanwhile, peaked at an all-time high exceeding $410/t fob Australia at the beginning of that month. In the US, HRC finally joined the downward trend in the rest of the world and started to come off in the second half of October and into November after peaking at an astonishing $1,960/short ton or $2,160/metric tonne.

Costlier inputs have continued to squeeze Turkish mills throughout November and December, pricing them out of Asian rebar markets, a situation that has been successfully exploited by supplier mills in the Middle East, a market that still a decade ago was heavily reliant on imports. The lira recording repeated all-time record lows in recent weeks has meanwhile hampered business in the Turkish domestic market. Turkish mills have consequently substantially reduced scrap purchases, which has seen prices of the feedstock come off in December after they had remained stubbornly high even amid iron ore dropping after the summer.

Amid these market developments, the global steel industry rapidly accelerated the decarbonisation process in 2021, as existing steelmakers announced ambitious low-carbon upgrades and new “green” steelmaking investments were established, most notably in Europe. Hydrogen has become the new buzz word of the day – this abundant gas is expected to fuel not just steel but industrial processes all over the world in the coming decades. The EU is encouraging the process with its Emissions Trading System, which penalises high carbon emitters. EU carbon permit prices have reached record levels, exceeding €80/t in December versus below €35/t at the start of the year. Until new technology is sufficiently developed, the push towards green steelmaking will increase production costs and support higher steel prices in some regions. The increased use in steelmaking of scrap as an immediate carbon reduction method will put pressure on the feedstock’s availability, again supporting prices. These trends are likely to become more apparent in 2022.

Another factor to watch will be how the US-EU trade pact affects each of the markets involved.

- What products will be imported into the US from the EU, from which producers and in what tonnages, and will this soften US domestic prices, which are considered by many as unsustainable?

- What other countries will the US agree trade deals with and will this create a closed market of certain regions that excludes others?

- What will be the outcome of the EU’s latest safeguard review, due for completion next June?

- To what extent will EU and US steel demand benefit from the Next Generation EU recovery instrument and US infrastructure bill respectively?

- With the Democrats expected to lose next year’s mid-term elections and a turbulent political year anticipated in the country, how will the steel industry be impacted?

- When will semiconductor shortages ease and automotive production rebound?

- Will manganese and graphite electrode shortages resurface to the detriment of steelmakers?

- What will happen to the Chinese real estate market in 2022 and what economic consequences will this have globally?

- What will happen to the steel surplus resulting from reduced Chinese steel demand next year?

Kallanish’s global team of journalists will bring you the answer to these questions and more, with the latest industry developments reported as and when they happen.

In the meantime, I wish you all a peaceful and reflective holiday period, and a Happy New Year.

Sincerely, Adam Smith

Global Editor

Kallanish Steel

German crude steel output points up

Crude steel output at German mills from January through November this year rose 13.5% over the first 11 months of 2020 to 36.92 million tonnes, according to figures provided by steel federation WV Stahl.

In November alone, production was on par with November 2020, at 3.37mt. Output at oxygen-route mills rose by 4.5% to 2.35mt, whereas that of EAF mills sank by nearly 10% to 1.01mt, Kallanish hears.

This apparently odd development can be attributed to a base effect, which already showed up earlier this autumn. The resurgence of production in late 2020 started initially at EAF mills, which were faster and more flexible than BOFs to respond to the rapid demand resurgence following lockdowns.

The fourth quarter saw the restart of the country’s biggest blast furnace, at thyssenkrupp’s works in Duisburg, following a reline. Therefore, it is likely that the full year will reach the 40mt mark.

Christian Koehl Germany

UK revises merchant bar, light sections safeguard quotas

Effective 1 January, existing UK steel safeguard category 12 quotas can no longer be used, and the HS codes falling under this category will no longer be subject to the safeguard measure. They will be split and replaced by two new quota product categories for merchant bars and light sections, with revised quota amounts.

Category 12 A will be alloy merchant bars and light sections, comprising HS codes 7228 30 20 10, 7228 30 20 90, 7228 30 41 10, 7228 30 41 90, 7228 30 61 10, 7228 30 61 90, 7228 30 69 10, 7228 30 69 90, 7228 30 70 10, 7228 30 70 90, 7228 30 89 10, 7228 30 89 90, 7228 60 20 10, 7228 60 20 90 and 7228 70 10 00. A country specific quota will apply for China.

Category 12 B will be non-alloy merchant bars and light sections, comprising HS codes 7214 30 00 10, 7214 30 00 90, 7214 91 10 10, 7214 91 10 90, 7214 91 90 10, 7214 91 90 90, 7214 99 31 00, 7214 99 39 00, 7214 99 50 00, 7214 99 71 00, 7214 99 79 10, 7214 99 79 90, 7214 99 95 10, 7214 99 95 90, 7215 90 00 10, 7215 90 00 90, 7216 10 00 00, 7216 21 00 00, 7216 22 00 00, 7216 40 10 00, 7216 40 90 00, 7216 50 10 00, 7216 50 91 00, 7216 50 99 00, 7216 99 00 10 and 7216 99 00 90.

Non-alloy and other alloy merchant bar and light sections were among the five product categories the UK government extended safeguard measures for last June after passing emergency legislation (see Kallanish passim). The measures on these products had initially been slated for removal.

Adam Smith Germany

Megasa stops production over Christmas on costlier electricity

Spanish steelmaker Megasa has stopped operation at both electric arc furnace-based plants in Naron and Zaragosa due to high energy prices. The company already communicated its decision to the workers’ council last Friday and implemented it at the beginning of this week.

Kallanish understands the production shutdown should remain in place until 7 January and it should have no impact on the workforce for now.

While most employees are already on vacation after maintenance and training, Megasa management admits this is a temporary solution and decisions will be made depending on the energy price situation in early January.

It is not yet clear how much production will be lost due to these stoppages. Supply should not be affected in the short term due to the Christmas holiday period.

Since November Megasa has maintained limited operations at the Naron and Zaragosa plants, producing only during nights, weekends and holidays when electricity rates are lower.

Similarly, high energy and natural gas prices are continuing to impact steelmaking operations at the EAF-based mill of ArcelorMittal in Sestao. Production at the facility has been halted since 7 December due to maintenance and updating of equipment. The plant is expected to return to operation in February. The company is constantly monitoring electricity and gas costs, and these remain worrisome, ArcelorMittal comments.

It is thought other steelmaking operations in Spain could implement production adjustment schedules during the winter (see Kallanish 22 December).

Todor Kirkov Bulgaria

Danieli to supply two BFs to Vietnam’s Hoa Phat Dung Quat Steel

Italy-based engineering company and steel producer Danieli will design and supply two blast furnaces to Vietnamese steelmaker Hoa Phat Dung Quat Steel, adding 5.6 million mt/year of steel capacity to the Dung Quat steel complex, Danieli said Dec. 23.

The complex already has production capacity of 5 million mt/year.

Danieli said the two new BFs would each have a nominal hot metal production rate of 2.5-2.8 million mt/year and be equipped with the Danieli’s high-conductivity cooling and lining design based on copper-plate coolers and graphite refractories.

The contract also includes the supply of level-two process automation systems and pulverized-coal injection systems, with part of the hot-blast systems included.

Hoa Phat previously ordered four working-volume blast furnaces in 2017, which are all currently operating.

Earlier in December, Danieli said it would be supplying a new bar-in-coil line to India’s special steel producer Arjas Steel.

In September, the company upgraded two hot-dip galvanizing lines at MMK Metalurji in Dortyol and Istanbul, Turkey.

— Jacqueline Holman

Demand to drive steel prices in 2022: Colakoglu CEO

Demand, rather than supply, will be the main driver of steel price trends in 2022, Ugur Dalbeler, vice president of the Turkish Steel Exporters’ Union (CIB) and CEO of major Turkish steel producer Colakoglu, told S&P Global Platts, adding that his expectation for the coming year is positive.

“I am expecting growth-intended policies to continue in the first half of 2022. Although interest rate hikes could be seen in the second half of the year, particularly in the US, cheap money could continue to support demand for a while further,” Dalbeler said, adding that he is not expecting any change in policy by China.

Highlighting that supply issues drove the direction of prices in global markets in 2021, the CEO said demand would be the determining factor in price direction this year instead of supply, which will be the big difference compared to 2021.

S&P Global Platts’ daily Northern Europe hot-rolled coil assessment reached a record high of Eur1,190/mt EXW Ruhr in June, but prices have fallen since to Eur925/mt on Dec. 23.

“While steel production will return to pre-pandemic levels in 2022, energy bottleneck and input prices, however, could pull down mills’ profitability,” Dalbeler observed.

Significant increases in energy costs arising from the huge currency depreciation in Turkey have restricted Turkish mills’ competitiveness in domestic and export markets, especially in the second half of 2021, as energy is one of their major input costs. Turkey is largely dependent on imports of energy, particularly natural gas.

Turkey’s Energy and Natural Resources Ministry ordered some Turkish electric arc furnace steel mills to pause melt shop production temporarily for three days on Dec. 21, due to some energy supply issues arising from a natural gas shortage.

Protectionism rollback

Noting that protectionism has been prevalent in steel markets in recent years, Dalbeler said he is expecting this to be gradually rolled back.

“As the US and EU reached a deal on Section 232 duties, around 80% of the US steel imports became exempted. Negotiations with Japan and the UK are also ongoing. Only Turkey left in these circumstances,” the CEO said, highlighting that the EU also recently started the safeguard review period two months before the normal period.

The European Commission formally initiated a periodic review into its steel import safeguard measures on Dec. 17, which will also assess how changes to be introduced Jan. 1 to the US Section 232 import tariffs may affect steel trade flows, as reported.

“As the US and EU mills have made serious profits in recent years amid protection measures, there isn’t any strong base left for protectionist measures,” Dalbeler said.

— Cenk Can

Partanum Consulting joins EUROMETAL as associate member

Partanum Consulting GmbH will become an associate member of EUROMETAL as of January 2022.

CEO of Partanum Consulting is Friedhelm Wagner, a former Managing Director of Klöckner Global Sourcing GmbH (a subsidiary of Klöckner & Co SE) and former member of Management Board of ThyssenKrupp Schulte.

Friedhelm Wagner is since 45 years active in steel trading and steel distribution on national and international level:

- active since year 2013 in procurement and sales of specific raw materials for steel production;

- specialised in Steel Procurement & Sales of 2nd choice/declassified carbon steel flat & long products in cooperation with a German company responsible for purchase & sales;

- cooperation with a German company for the implementation of Energy Efficiency in the light of Co2 reduction processes for Steel Service centre, Steel mills & Steel – Distribution companies and a general and specific cost optimization program.

- cooperation with a German company for coaching of sales- people based on Total Quality Selling (TQS) which is the method hat considers the entire sales process from the receipt of an inquiry, or the first acquisition contact, up to the final sale including price negotiation & -adjustment processes.

HDG market participants uncertain about strong auto comeback in Q1

European hot-dipped galvanized steel prices softened Dec 22 as the market contended with hand-backs from automotive manufacturers amid the semiconductor shortage and the uncertainty of prices in the new year. Sentiment remained mixed about how quickly automotive demand would return in Q1, with some on the buy side still apprehensive to book if lower prices could be on the horizon, sources told S&P Global Platts.

A German distributor said mills were still trying to lock in key business by handing out discounts and added he did not consider the return of automotive demand to be a strong point for the new year.

“Mills are really under pressure to fill order books,” the distributor said. “For auto, it’s not the problem of microchips — it’s a problem of our future. Auto will never come back to their own strengths before this crisis because more countries are ruling that electric vehicles will be the future. They won’t need the same amount of steel; demand will go down.”

In the Italian market, a service center source was still skeptical about the strong return of the auto industry in Q1, despite chatter that major car manufacturer Stellantis was looking to restart production in the near term.

“No movement in automotive, no strong demand,” he said. “Stellantis are starting to allocate production, but not sure if this is the case.”

Others were more optimistic about a bounce-back, with some sources expecting a strong rebound in automotive demand and prices in Q1.

A European mill source said his forecast for Q1 was mostly focused on securing March orders with a “much better view” on automotive demand. The source confirmed that several OEMs had already announced more working shifts because of an easing in the shortage of auto components.

“Stellantis announced microchip and semiconductor issue is better for them,” the mill source said. “January is already better and am expecting peak demand.”

The source added that last week at a conference, a car manufacturer confirmed the restart of night shifts after Jan. 3 because of more availability of components.

“Auto has been low during the last quarter and it hit the mills — auto represents 20% of total production,” the same source said,

“Should they shut down completely or make discounts? That happened, but it’s over now,” the source said, highlighting bullish expectations for 2022.

— Amanda Flint

Tata Steel UK supplies sections for Dogger Bank wind farm

Tata Steel, which has steelmaking operations in the Netherlands and the UK and manufacturing plants across Europe, said Dec. 22 its UK-made steel is being used to create the world’s largest offshore wind farm, Dogger Bank, 130 km (81 miles) off the northeast coast of England in the North Sea.

Steel made in Tata Steel’s Port Talbot plant and processed into hollow sections at the company’s Corby and Hartlepool sites, all in the UK, is now being fabricated by one of the thousands of contract companies engaged building the first two phases of the Dogger Bank wind farm.

Tata Steel is supplying about 250 tons of steel per wind turbine. To endure the North Sea environment, this is made of the fully normalized hot finished hollow sections of EN 10210, designed to perform in the most arduous conditions. These hollow sections are going into the access platform and associated steelwork — the connection between the wind tower foundation and the jacket above.

Dogger Bank’s first two phases were reported to use 190 13MW offshore wind turbines, but the steelmaker has not specified whether its steel will be used in all of them.

“Huge amounts of steel will be needed to help the UK achieve its net-zero goals — to build everything from renewable energy and low-CO2 transportation to hydrogen production and distribution,” said Sandip Biswas, chairman of Tata Steel UK.

Based on the expected need for carbon capture, utilization and storage and hydrogen infrastructure, this additional demand for steel is likely to run into more than a million tons by 2050, according to industry estimates.

— Ekaterina Bouckley