France’s metal industry output up 0.9 percent in February from January

France’s manufacturing output in February this year increased by 0.9 percent month on month, after going down by 1.5 percent in January, according to the statistics released by France’s National Institute of Statistics and Economic Studies (INSEE).

In the December-February quarter, France’s manufacturing output was up by 0.2 percent year on year and down by 0.1 percent quarter on quarter.

In the given month, France’s production in manufacture of basic metals and fabricated metal products, except machinery and equipment, increased by 0.9 percent compared to January, after a 2.6 percent decrease month on month in the previous month.

On the other hand, in February production of France’s motor vehicles, trailers and semi-trailers industry went down by 1.3 percent on month-on-month basis after going down 5.3 percent on month-on-month basis in the previous month, while the output of the domestic construction industry decreased by 2.1 percent month on month in the given month after going up by 0.2 percent in January compared to December. In the December-February quarter, output of the domestic construction industry increased by 0.2 percent quarter on quarter.

Mood in the EU HRC market remains bearish on weak demand

Sentiment in the European hot-rolled coil market was bearish on April 4 due to weak demand and oversupply.

On April 4 Northwest European HRC prices remained stable after a Eur25/mt drop a day earlier.

The decline was driven by lower offers from the mills that have been struggling to fill May order books.

“The offers drop shows that the mills are desperate to fill order books and they are willing to drop the prices,” a German service center said. “They should have reduced production.”

Majority of market sources agreed that the production cuts and blast furnace stoppages are the only solution to prevent the price collapse.

Market participants believe that the domestic HRC prices would reach Eur600/mt ex-works by the end of April.

Platts assessed domestic prices for hot-rolled coil in Northwest Europe unchanged on day at Eur640/mt ex-works Ruhr on April 4.

Tradable values were reported at Eur630-640/mt ex-works Ruhr with majority of data heard at Eur640/mt ex-works Ruhr.

Offers from integrated mills have been heard at Eur650-670/mt ex-works Ruhr.

Platts assessed domestic prices for hot-rolled coil in South Europe down by Eur15/mt on the day to Eur620/mt ex-works Italy on April 4.

The assessment was based on tradable values heard at Eur615-625/mt ex-works Italy.

Europe longs: Mills expect firmer market

Most European producers increased their offers for long products this week, anticipating demand to improve after the Easter holiday period and propped up by a rebound in scrap costs.

The Argus weekly Italian rebar and drawing-quality wire rod assessments remained at €570/t ($620/t) ex-works and €645/t delivered, respectively.

In Italy, rebar sales prices remained at €560-570/t ex-works, including extras for sizes, but mills announced offers at up to €600/t ex-works, referring to increasing scrap costs. Buyers were sceptical about the price increases as mills still needed to fill their April order books and there were no expectations for substantial increases in consumption. Buyers that needed to replenish stocks placed orders in late March, when there were signs that prices had bottomed out.

In the nearby markets, no fresh offers were reported. Rebar was quoted at €570-580/t fca late last week, when some Italian mills were eager for new sales. In particular, the tradeable value for rebar in Poland was reported at €615-620/t delivered this week, while in late March deals were concluded slightly below this. In the meantime, offers for Polish rebar stood at €625-630/t delivered to domestic buyers, while in nearby markets prices were pegged at €625-640/t delivered. Similar prices were available for overseas material from docks in the Baltic region.

In Germany, prices for small-to-medium purchases of rebar remained at €630-640/t delivered. Spanish rebar was still quoted at €615/t cfr to northwest Europe, with small discounts deemed available. But mills are likely to try and increase prices should they see demand.

In the Balkan region, Bulgarian rebar prices settled at 1,190-1,210 lev/t (€608-619/t) delivered late last week, while in Romania rebar was available at €630-640/t delivered.

But some customers showed more interest in overseas offers in late March. Rebar was mainly booked from Turkey, as prices were at $585-590/t fob, which would be below €600/t delivered in any region. Egyptian rebar was quoted at $580-590/t fob, but was available for later shipment.

Southern and northwestern European customers were booking Asian wire rod at $520/t fob in late March, which is estimated at no higher than $600/t cfr depending on the ports. Some buyers expressed concerns that the next “other countries” quota could be exhausted promptly again, as almost 83,771t were awaiting clearance in the first days of April. Turkish allocation was estimated to be filled promptly in this period too.

Trade restrictions supported stronger prices for wire rod in Europe, with mills announcing up to €20/t price increases. In particular, new offers for drawing quality material in the Italian market were indicated at €650/t delivered. In other markets, mills pushed up offers from €660/t delivered to up to €680/t delivered. Mesh quality wire rod in Germany and other nearby markets was available at €620-630/t delivered.

How will the EU’s CBAM impact global iron and steel?

The Carbon Border Adjustment Mechanism has big implications for international trade patterns.

While it’s an EU regulation, the Carbon Border Adjustment Mechanism (CBAM) aims to encourage decarbonisation at a global level. As the new rules will affect anyone who exports to the EU, it promises to have significant consequences for international trade.

In our latest insight, our metals and mining sector analysts set out the details of the Carbon Border Adjustment Mechanism and assess its implications for the iron and steel sector, which is the largest by import value of the six sectors covered by the first phase of the scheme.

Fill out the form to download a free extract from the report, or read on for an overview that touches on the implications for other commodities.

What is the Carbon Border Adjustment Mechanism?

The CBAM aims to address the issue of so-called ‘carbon leakage’. The EU defines carbon leakage as ‘the situation that may occur if, for reasons of costs related to climate policies, businesses were to transfer production to other countries with laxer emission constraints’.1 The EU looks to address the risk of carbon leakage by taxing imports to equalise the carbon price paid by EU and non-EU products.

What sectors does it cover?

Initially, the CBAM will cover six sectors, with a focus on carbon-intensive and trade-exposed industries that are at the high risk of carbon leakage. These are electricity, hydrogen, cement, fertilisers, aluminium, and iron and steel. Later it will be extended to all sectors covered by the EU’s Emissions Trading System (ETS) by 2030. The bloc will also assess whether to extend the mechanism to organic chemicals and polymers by the end of the transition period, and will look at the potential to cover indirect emissions for more sectors and a wider range of downstream products.

When does it come into effect?

- October 2023 – Transitional period: Importers of products covered by the initial scope only have reporting obligations for the purpose of the CBAM

- January 2026 – Financial obligations commence: Importers will face financial obligations of surrendering CBAM certificates, which will ramp up progressively. Free allowances for CBAM-targeted sectors under the EU ETS will start to phase out.

- On or before 2030 – Extension: Regulations will be widened to all sectors covered by the EU ETS

- By 2034 – Full implementation: The CBAM will reach full effect for the initial batch of sectors and allowances will be all allocated via auctions for these sectors under the EU ETS

How will it work?

Until now, industrial installations within the EU considered to be at significant risk of carbon leakage have been receiving free allowances under the EU ETS to support their competitiveness. The CBAM will replace these free allocation, which will be phased out between 2026 and 2034 at the same pace as the CBAM is phased in.

CBAM financial obligations will be determined by the embedded emissions of imported goods and the price of the CBAM certificate, which is based on the EU ETS price. Carbon price effectively paid in the export country can be deducted (see diagram below).

Why has iron and steel been chosen?

The iron and steel sector is large, trade exposed and emissions intensive, making it a prime candidate for inclusion in the CBAM. European producers face significant competition, with 30% of EU demand for steel basic materials and key intermediates met by foreign supply. Price is a major factor, with EU steel producers facing higher production costs than their foreign competitors. As the energy transition progresses, higher carbon prices will further corrode their competitiveness.

Emissions from crude steel production in most of the bloc’s major steel trade partners, including China, India and Russia, are notably higher than the EU average, yet none of these countries places a carbon price as high as the EU’s. The CBAM is intended to address this discrepancy and create a level playing field for domestic production. The mechanism will cover CO2 emissions from a range of imported products, including pig iron, semi-finished and finished steel, some fabricated steel, and downstream items like nuts, bolts and screws.

What will the impacts of the CBAM be?

In the long term, the CBAM could lead to global decarbonisation of affected sectors and downstream consumption. However, collateral damage should also be expected.

Cost growth will be moderate in the first few years of the CBAM payment. During this period, exporters to the EU could reorganise their production and sales to direct lower-emissions products to the European market as a short-term fix. However, they may simply avoid the higher cost of operating in the EU market, creating supply shortages. Meanwhile, carbon costs will rise for EU producers as free allowances are phased out.

In the longer term, however, carbon will become an increasingly important cost component to consider. This will eventually impact steel trading patterns and encourage exporters to the EU to invest in emissions reduction technology. At the same time, the bloc’s trading partners will be incentivised to introduce or raise their own domestic carbon prices to prevent revenue leakage (although it should be noted that they are likely to remain structurally weaker than the EU’s).

On the downside, higher carbon costs and disrupted supplies will impact downstream manufacturing, leading almost inevitably to price increases for both domestic and foreign products. Steel is also widely used for renewable energy applications such as wind turbines and electric vehicles; higher prices and added strain on the supply chain could, therefore, make the energy transition more expensive in the EU than elsewhere.

Learn more: Implications of the CBAM for the iron and steel sector

Revista InfoAcero Marzo 2024

En el siguiente enlace pueden acceder a la edición de Marzo de nuestra revista INFOACERO.

Destacamos a continuación algunos de sus contenidos:

- Opinión – D. Manuel García- Junta Directiva UAHE

- Evolución del Índice de Precios de Productos Siderúrgicos – UAHE

- Sector Metal: Actividad Productiva y Comercio Exterior – Confemetal

- Siderurgia: Previsión de los sectores consumidores de la UE 27 – Informe Eurofer – 1er trimestre 2024

- Información Asociativa: Nuevo servicio UAHE-Gestión de Riesgos // Próximos Cursos UAHE

- Steel Net Forum Iberia 2024: 11 y 12 de Abril en Santiago- ¡ÚLTIMA LLAMADA!

DRI usage will continue to grow: IIMA adviser

Expansion in direct reduced iron (DRI) consumption is likely while the world’s steelmakers strive to decarbonise production and to secure future feedstock, Kallanish learns from an article by consultant Robert Mazurak.

Mazurak, an adviser to the International Iron Metallics Assocaition, says the use of DRI and hot briquetted iron (HBI) in steelmaking is gaining broader acceptance. Global DRI production has risen since 2016 by nearly 8 million tonnes per year.

“The accelerated growth rate in DRI production may well continue, such that likely we will be seeing another 60mt of incremental DRI output by the end of 2030 to reach an annual level of 185-190mt, rising to 13% of the combined BFI plus DRI ironmaking total,” Mazurak states in his article, published on the Midrex website.

The president of Mazurak Resource Consulting is cautiously optimistic that ore-based metallics (OBM) growth rates will be sustained, with accelerated production and use of all forms of DRI. This comes with new iron ore briquetting hubs, including one announced by Vale, that will likely rise to serve multiple off-takers in targeted regions to feed both existing and new DRI plants.

Straight melting of scrap in an electric arc furnace (EAF), combined with “green” power sources such as hydrogen, results in much lower emissions and carbon footprint compared with traditional steelmaking. Melting scrap and DRI in an EAF is the next best alternative.

To that end, hydrogen-enriched gas-based reduction of iron ore in DRI plants, plus arc furnace melting of DRI and scrap, currently offers the primary pathway for lowest carbon emission steelmaking.

“I’ve been chastened in my belief that breakthrough smelting reduction technologies would have gained more traction by now as competition to the DRI-EAF steelmaking route. It now seems clear that the ‘tried and true,’ proven DRI technologies will be the ones to proliferate over the next several decades,” states Mazurak, adding: “Advancements in direct smelting technologies could slowly develop and ultimately impact DRI plant capacity growth rates.”

Over the last 20 years, cold DRI (CDRI) production went from 39mt to 102.1mt, while hot DRI (HDRI) soared nearly eight-fold, from 1.8mt to 13.0mt in 2022.

“The rapid rise in HDRI use in the EAF is from the recognition that it provides the benefits of quicker melting and an energy savings from the retained, latent heat. However, global hot briquetted iron production has increased only marginally, from 8.6mt in 2003 to 11.4mt in 2022, despite being the most desirable DRI form for seaborne trade,” notes Mazurak.

Other recognised applications gaining acceptance include HBI use in blast furnaces for productivity enhancement and in basic oxygen furnaces as trim coolant.

John Isaacson USA

Steel workers voice concern over ‘irresponsible’ green transition

Rising global steel overcapacity due to “irresponsible” practices by some multinationals and “misguided action” by governments failing to invest in the green transition is damaging the steel workforce in favour of short-term profit maximisation. So says the Trade Union Advisory Committee (TUAC) to the OECD.

At the OECD Steel Committee meeting in Paris on 25-26 March, TUAC says it raised issues with some steel companies refusing to sit at the table with union representatives.

Multinational companies are “exploiting competition between states over decarbonisation aid,” TUAC says in a note seen by Kallanish. “There is a growing concern that workers will bear the cost of essential investments for carbon emission reduction, through mass dismissals rather than upskilling and re-training, even in steel companies that are not under financial pressure.”

“TUAC partners argue that the current changes in the steel industry do not equal a just transition, instead fearing an unjust transition where only financial goals are pursued over environmental and social priorities. TUAC, IndustriALL Global Union and industriAll Europe urgently call for a re-evaluation of priorities within the steel industry, advocating for a balanced approach with workers at the table,” TUAC says.

“We call on governments to make financial support to steel companies conditional on new investments in green technology, retention of workers and respect of social dialogue,” it concludes.

Adam Smith, Poland

Thyssenkrupp Steel to connect to GET H2 German hydrogen pipeline in 2028

Thyssenkrupp has signed a realization agreement with gas transmission system operators Nowega, OGE and Thyssengas to connect its Duisburg steel plant in Germany to the GET H2 hydrogen pipeline network in 2028 as it seeks to decarbonize its operations.

The GET H2 pipeline project plans to connect green hydrogen production hubs with industrial consumers in the Lower Saxony and North Rhine-Westphalia regions.

“With this contract, the hydrogen economy in North Rhine-Westphalia and Germany continues to take shape,” the companies said in a statement March 21.

The 135-km pipeline network between Lingen and Gelsenkirchen will be extended to the Duisburg steelworks via a 40-km link from Dorsten. GET H2 in turn will link to the planned national hydrogen pipeline network.

Thyssenkrupp is looking to move to hydrogen-based steel production, and is to construct a 2.5-million mt/year direct reduction iron plant to replace the four blast furnaces at Duisburg. First production is scheduled from the end of 2026, avoiding up to 3.5 million mt/year of CO2 emissions.

The direct reduction plant will reduce iron ore pellets to sponge iron using hydrogen, with natural gas in the interim.

In February, Thyssenkrupp issued a tender to purchase up to 151,000 mt/year of renewable and low-carbon hydrogen under 10-year contracts, with lower volumes starting from 2028, for pipeline delivery to the Duisburg steelworks.

The steelmaker will seek an expected 104,000 mt of hydrogen in 2028, rising to 143,000 mt/year over 2029-35 before reaching 151,000 mt/year over 2036-37 as it seeks to decarbonize the plant.

The gas TSOs are to convert existing gas pipelines between Vlieghuis in the Netherlands and Kalle and onward to Ochtrup to transport hydrogen and connect to the GET H2 pipeline system by 2027, with the Duisburg plant connected in 2028.

Thyssenkrupp said previously that as sufficient green hydrogen would not be available when the plant starts, it plans to use natural gas when the DRI plant is commissioned, with blue hydrogen acting as a bridge before renewable production ramps up.

Platts, part of S&P Global Commodity Insights, assessed the cost of producing hydrogen via alkaline electrolysis in Europe at Eur4.46/kg ($4.85/kg) March 20 (Netherlands, including capex), based on month-ahead power prices. Proton exchange membrane electrolysis production was assessed at Eur4.90/kg, while blue hydrogen production by steam methane reforming (including carbon, CCS and capex) was Eur2.34/kg.

The contract between Thyssenkrupp and the gas TSOs regulates the hydrogen pipeline conversion and construction, as well as rights and obligations of the partners until the start of operations.

Thyssenkrupp steel decarbonization

Thyssenkrupp Steel is the largest flat steel manufacturer in Germany, producing around 11 million mt/year of crude steel.

The company aims to cut CO2 emissions by over 30% by 2030, targeting climate neutrality across all its sites by 2045.

In July, the European Commission approved a German Eur550-million direct grant and conditional payment mechanism of up to Eur1.45 billion to support ThyssenKrupp Steel Europe in decarbonizing its steel production and accelerating renewable hydrogen uptake.

Europe-based buyers have started to show greater interest in carbon-accounted steel. Platts assessed Northwest European hot-rolled carbon-accounted coil down Eur5 on the day at Eur800/mt ex-works Ruhr March 20.

GET H2 network

The GET H2 network consortium also includes BP, RWE and Evonik.

In September, RWE produced the first hydrogen at its test electrolyzer in Lingen for a pipeline transport and storage trial.

The 250-kW high-temperature solid oxide electrolyzer from manufacturer Sunfire will produce up to 7 kg/hour of hydrogen for the GET H2 TransHyDE project, which will test hydrogen pipeline transport and storage from 2024.

RWE plans to start up a larger 14-MW pilot electrolyzer plant for industrial-scale production at Lingen in the coming months. The 14-MW plant will test the use of two electrolyzer technologies, pressurized alkaline and proton exchange membrane, which RWE is considering for future projects.

It also received construction and operation approval for the first two 100-MW electrolyzer plants of its 300-MW GET H2 Nukleus project in Lingen in September.

The 200-MW plant will produce up to 35,000 mt/year of green hydrogen for industrial decarbonization.

And in October, OGE and Nowega began work to convert the first 46-km section of pipeline from the OGE compressor station in Emsburen to Bad Bentheim in Lower Saxony and on to Legden in North Rhine-Westphalia for hydrogen use.

The conversion will see the pipeline sections separated from the gas network after which upgrade measures for the transport of hydrogen will begin. The pipeline would then be ready to flow hydrogen from 2025.

Author: James Burgess, james.burgess@spglobal.com, Annalisa Villa, annalisa.villa@spglobal.com

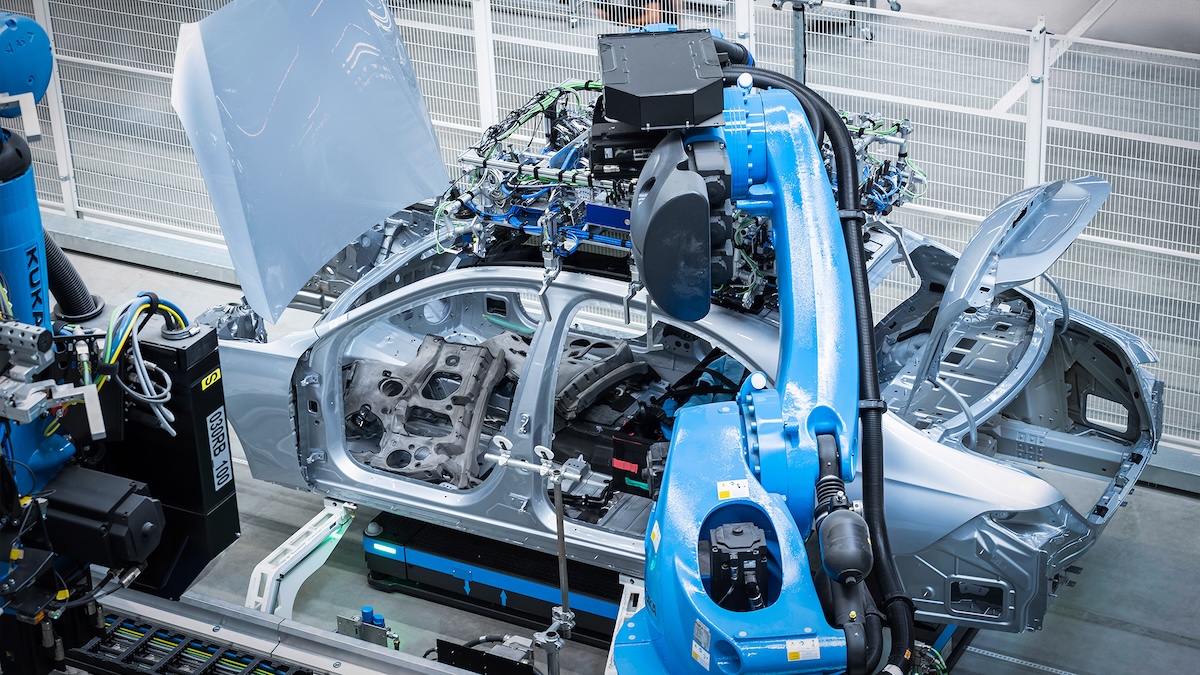

US’ Nucor to supply Mercedes with low-embodied carbon steel

Nucor has signed an agreement with Mercedes-Benz to supply certified low-embodied carbon steel for vehicle models produced at the automaker’s Tuscaloosa, Alabama, plant, the US-based steelmaker said in a statement March 20.

Nucor will supply Mercedes with its Econiq-RE steel products, which are produced with 100% renewable energy, reducing greenhouse gas emissions to less than half of that of blast furnace-based steel production for Scopes 1, 2 and 3 emissions, it said. Econiq, launched in 2022 with General Motors as the first customer, is not a single product; it is a net-zero certification, which can be applied to any product from Nucor’s steel mills, according to the company’s website.

The agreement comes as Mercedes and other global automakers look to decarbonize supply chains, increasing demand for low-emissions steel.

The use of Nucor’s Econiq brand will reduce carbon emissions throughout Mercedes’ supply chain, according to Dan Needham, Nucor’s executive vice president for commercial. Associated volumes were not disclosed.

“Our Econiq brand is helping steel end-users meet their growth and sustainability goals, and we are proud that it is going to be a key piece of Mercedes-Benz’s path towards a net carbon-neutral new car fleet along the entire value chain,” Needham said.

Mercedes has set a goal to have its entire fleet of new vehicles be net carbon neutral across its entire value chain by 2039. To support this, it has signed agreements to source low-carbon steel with Germany’s Thyssenkrupp Steel, Italy’s Arvedi and Sweden’s H2 Green Steel to supply its European operations.

In the US, Mercedes signed an agreement with Steel Dynamics Inc. in September for the supply of more than 50,000 st/year of CO2-reduced steel for its Tuscaloosa auto plant.

Amid growing demand for greener steel products, low-carbon premiums have emerged in Europe. Platts, part of S&P Global Commodity Insights, last assessed Northwest European hot-rolled carbon-accounted coil at Eur805/mt ($874.3105/mt) ex-works Ruhr March 19, reflecting a premium of Eur125/mt over the Northwest European HRC price of Eur680/mt the same day.

The assessments reflect trade in HRC with carbon emissions certified by an internationally accepted, independent organization. The European HRC Carbon-Accounted Steel Premium reflects any differential achieved for the spot sale of hot-rolled steel on an ex-works basis, with total accounted carbon emissions of 2.1 mt of CO2, or less, for every metric ton of steel produced.

Author: Justine Coyne, justine.coyne@spglobal.com

UK details carbon border tax proposals as it kicks off consultation

- Seeks views for the design and administration of CBAM

- UK CBAM to start in 2027, a year after EU

- Iron, steel and aluminum sectors likely to be heavily impacted

The United Kingdom launched a consultation to help it design a carbon border tax on imports of emissions intensive products from 2027, the government said March 21.

The consultation, that will run for a 12-week period ending June 13, is part of the country’s efforts to introduce a carbon border adjustment mechanism (CBAM) by 2027 on imports of goods from the following sectors: aluminum, cement, ceramics, fertilizers, glass, hydrogen, iron and steel.

The purpose of the consultation is to gather views hear from importers and their agents, other businesses, individuals, tax advisers, trade and professional bodies and other interested parties, including those overseas, according to documents released by the UK Department for Energy Security and Net Zero.

The charge applied by the UK CBAM will depend on the amount of carbon emitted in the production of the good and the gap between the carbon price applied in the country of origin – if any – and the carbon price faced by UK producers.

Under the current proposal, the government will set and levy seven rates of tax, one for each sector.

This rate, which will be set by the government, will be determined by a methodology and updated on a quarterly basis, reflecting the price of UK Allowances under the UK Emissions Trading Scheme.

“The UK CBAM rate will be reduced (potentially to zero) if the embodied emissions in the CBAM goods were subject to a carbon price overseas that was greater than or equal to the UK CBAM rate for that sector,” the document said.

UK carbon prices have been extremely weak in the past 12 months on weaker demand due to lower power generation and weak manufacturing numbers, along with doubts over the government’s climate commitments.

Platts, part of S&P Global Commodity Insights, assessed UKAs at GBP35.60/mtCO2e on March 21. This is a slight rise after prices fell to a record-low of GBP31.42/mtCO2e on Jan. 29.

Prone sectors, countries

The document also said that based on historic trade flow data, the iron and steel and aluminium, will be most exposed to its CBAM.

The total value of CBAM imports from iron & steel and aluminium in 2023 were GBP4.5 billion and GBP11.87 billion respectively, according to HM Revenue and Customs data. The mechanism is likely to have a notable impact on the EU, China, Turkey, US, India and Taiwan, which are the top 5 origin markets of CBAM imports, the document showed.

The first accounting period for the carbon leakage tax will run from Jan. 1 to Dec. 31, 2027, while from 2028, the periods will become quarterly.

“Using a quarterly reference to the UK ETS price would allow for the UK CBAM rate to track the changes in the UK ETS price throughout the year, whilst balancing the need to give importers certainty on the price they will pay for their consignments in each reporting period,” the document added.

This comes after the EU’s own CBAM entered into force in its transitional phase from Oct. 31, 2023. The main purpose of CBAM seems to be to push the European industry to significantly decarbonize without being undercut by other geographies with no carbon costs.

However, EU’s CBAM, will fully apply from 2026, a year before the UK tax. This mechanism also obliges companies that import into the bloc to pay a tax to account for the difference between the carbon price paid in the country of production and the price of carbon allowances in the EU ETS.

The UK ETS, which became operational in 2021, is currently in its first phase, set to run until 2025. It regulates CO2 emissions from power generation, emissions-intensive heavy industries and aviation — a similar sectoral scope to the EU ETS. The UK has set a target to reduce emissions by 78% by 2035 compared with 1990 levels before reaching net zero by 2050.

Author: Eklavya Gupte, eklavya.gupte@spglobal.com