German steel producers, traders, and buyers foresee a continuation of bearish pricing trends over July alongside clear expectations of reduced production, data from S&P Global Commodity Insights’ monthly steel sentiment survey shows.

The July pricing index was at 29 points, up 9 points from June, with production and distribution respondents seeing prices as lower, but to different extents. The price index for distribution respondents for July stood at 20 points, unchanged from June. However, producer sources were less bearish on the month, with the producer index rising 18 points to 38.

“There is no point in mills cutting prices further, it wouldn’t help return buyers to the market,” one flat steel distributor said. “Price isn’t an issue now — demand is.”

Demand for steel products remains muted across Europe on strong inventories due to panic buying following Russia’s invasion of Ukraine in February, logistical delays to the arrival of import material, reduced end-user demand, and reluctance to restock against pricing downtrends — independent of the traditional relaxation of activity in the summer period.

“Everyone is depleting stocks at the moment and there’s hesitation to restock while prices plummet,” said another flat steel producer. “There’s been no need to place large orders with prices going down every week, but soon buyers will need to reserve for September, so we’ll see some demand return albeit at more limited volumes than usual.”

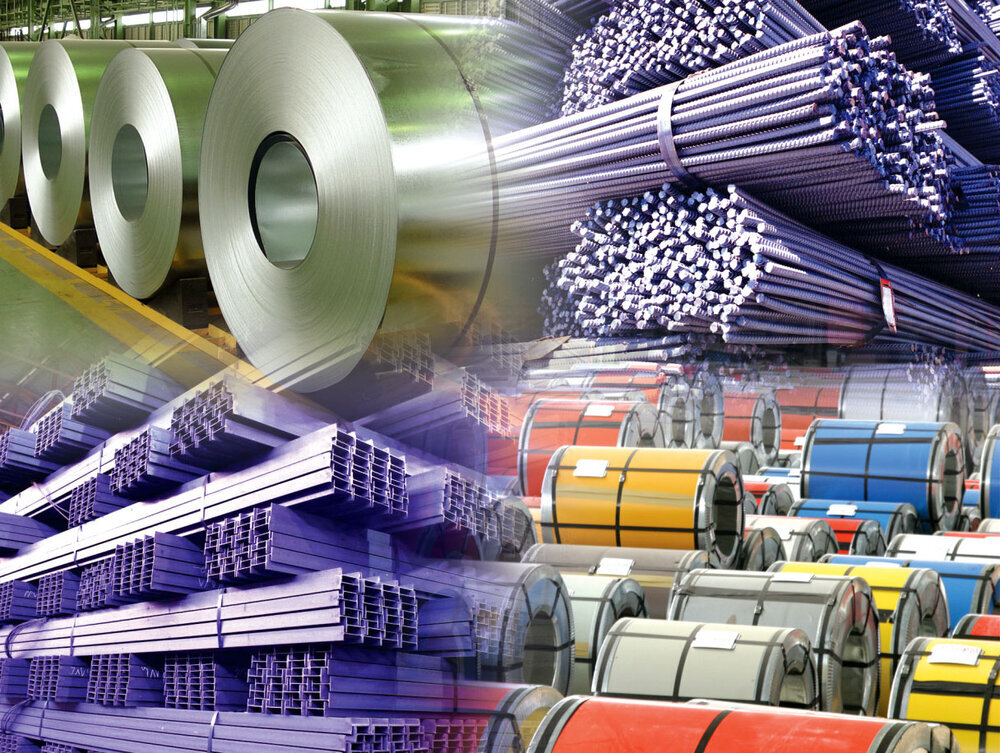

In the flat steel market, Platts assessed hot-rolled coil in Northwest Europe down Eur135/mt on month July 1, at Eur840/mt ex-works Ruhr, according to S&P Global data.

For long products, Northwest European rebar moved down Eur165/mt, assessed at Eur1020/mt ex-works, June 29.

Production down, mixed expectations on inventories

Despite weakened end-user activity, stock levels have reportedly been decreasing across Europe, with some demand revival expected in July.

Consequently, the overall index for July inventories still predicted a decrease in stock levels, standing at 40 points, up 5 from June. Producer respondents remained unchanged at 25 points, but distribution sources increased 10 points from June to 55 points, suggesting expectations of an increase, perhaps tied to restocking sentiments.

The overall production outlook fell 7 points to 18 points for July, with distribution respondents unchanged at 20 points. Producer expectations for July almost halved, however, with the producer index at 17, down from 30 points in June.

Market sources throughout June have reported a need for production cuts to balance supply with currently muted demand. Leading producer ArcelorMittal has announced the idling of two blast furnaces in France and Germany, while prime mill Salzgitter has elected to delay the restarting of one of its furnaces. Other mills have been heard as running at near-minimum capacities or preferring to extend scheduled summer maintenance, in lieu of other equipment stoppages.

Further output cuts are predicted by sources for July, in line with July’s production index of 18, with flat steel sources in particular expecting mills to announce decreases in output.

“Not everyone has decided the full actions to put in place in response to current market conditions — namely low demand and high costs,” said a flat steel producer. “There’s minimal trade in the summer anyway so many will elect to extend maintenance periods — but I’d expect some surprise additional cuts in the coming weeks.”

— Benjamin Steven, Rabia Arif, Maria Tanatar