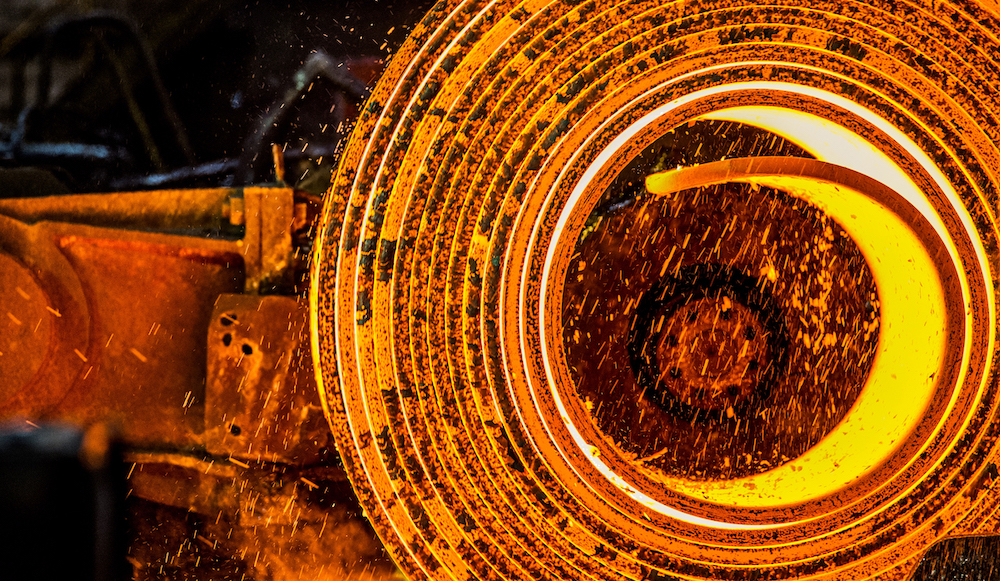

European steelmakers have been struggling to sell this year’s delivery hot-rolled coil amid low demand from both distributors and end-consumers, market sources said on Oct. 21.

Platts assessed hot-rolled coil in Northwest Europe stable on day at Eur660/mt ex-works Ruhr.

A Northern Europe-based service center reported transactions at Eur650-670/mt ex-works Northern Europe.

Other market participants generally reported tradable values on a range of Eur650-670/mt ex-works Ruhr for near-term trades. Two distributors reported offers at Eur700/mt ex-works Ruhr. One of the sources said that the offer was for the first quarter of 2023 delivery coil and that for December delivery material prices were lower.

Buyers have been showing little interest in coil delivered in December due to a focus on destocking by the end of the year, following the traditional cycle. Buyers have high inventories that they have been struggling to reduce due to low steel demand from end consumers, particularly the automotive industry.

Demand for first-quarter delivery HRC has also been muted, as a lot of distributors have enough material in stocks until February-March. Additionally, an uncertain outlook on steel consumption and energy costs did not support buyers’ interest.

“Demand would not recover in a couple of months,” an Italy-based service center said. “Nobody is willing to buy a single ton, particularly as mills are trying to fill order books for near-term and to offer this year delivery.”

In order to protect domestic prices, European steelmakers started to offer export to Turkey in an endeavor to reduce domestic availability.

Offers and deals for HRC from Europe have been reported in Turkey at Eur630-650/mt CIF.

“European mills are actively trying to export volumes to ease pressure on domestic prices and fill rolling program to keep equipment running,” a Northern Europe-based distributor said. “We need production cuts, those implemented were not enough.”

Platts assessed HRC in Italy down Eur10 on day to Eur680/mt ex-works Oct. 21.

Italian mills have been offering HRC at Eur700/mt ex-works, but market participants estimated achievable prices at Eur670-690/mt ex-works.

“Italian mills are aiming for Eur700/mt ex-works for HRC, but I think you can easily get Eur670-680/mt ex-works,” a second Italy-based service center said. “And it seems that with such demand Italian mills will soon decrease prices further reaching same level as German mills – Eur650/mt ex-works”.

Some market sources expressed concerns that domestic HRC prices have not reached bottom tier. This was due to the recent energy costs reduction and the fact that some integrated mills sell energy obtained from blast furnace and coking battery gases to compensate low finished steel prices.

“Energy costs have moved down recently so mill have room for further decrease,” a third Italy-based source said. “And taking into the account that some integrated mills sell energy from either blast furnaces or coke batteries, so that gives them opportunity to cut coil prices even further.”

Platts is part of S&P Global Commodity Insights.

— Maria Tanatar, Benjamin Steven