Italian sections prices rise

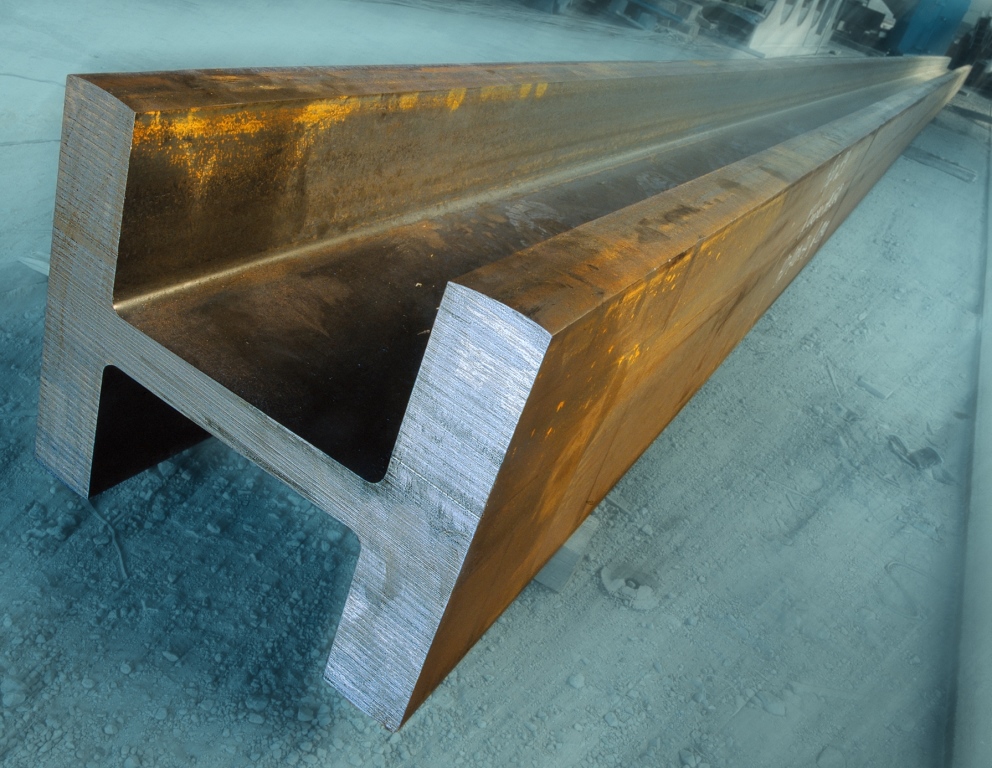

Italian beam producers are seeking €40/tonne ($48) hikes compared to April, while contract prices are gradually increasing, driven by scrap and strong demand for all steel products, Kallanish learns from market sources.

Domestic sections are rising after a difficult second half of 2020 when demand remained weak due to the lack of new infrastructure projects. Producers are now asking for €380/t base ex-works in new transactions. A previous round of increases towards the end of April was accepted by all buyers, sales executives and purchasing groups confirm.

Transactions this week are at €360-375/t base ex-works for the first category of beams. Including €385/t average size extras, values are reaching €745-760/t ex-works. Prices increase by €20/t for each subsequent category, sources suggest. Buyers however still complain about local demand being “average”.

Meanwhile, Italian merchant bar is also increasing in asking prices and contracts this month, by €30/t. May contracts have gone through the level of €700/t for the first time in years (see Kallanish 5 May).

Natalia Capra France

Liberty appoints restructuring committee, eyes underperforming units solution

Liberty Steel has appointed four new board directors to lead and accelerate its restructuring and refinancing. The appointments represent a step forward in Liberty’s response to the collapse of its principal lender, Greensill Capital, the firm says.

Liberty Primary Steel and Mining Australia agreed on Wednesday terms to refinance its Greensill exposure (see separate Kallanish story). Record steel prices and Liberty’s operational improvement programme have enabled its core businesses to maintain their strong performance since the beginning of the year.

The new appointments will join the Liberty board with immediate effect and form a new Restructuring & Transformation Committee (RTC), which will be led by an independent chief restructuring officer (CRO). It will include an independent chief transformation officer (CTO), a chief governance officer (CGO) and a newly appointed chief financial officer. The RTC will be supported by Liberty management and report to the full Liberty board.

“The RTC will be given full autonomy to restructure Liberty’s operations to focus on core profitable units, and either fix or sell underperforming units,” Liberty Steel says. “This restructuring combined with the continuing strength in steel and iron ore markets will present a solid basis for the future of Liberty.”

The RTC will work to “negotiate an amicable solution with Greensill’s administrators and other stakeholders which protects value and provides the best outcome for all stakeholders”, the firm adds.

Jeffrey Stein, a US-based certified turnaround professional, will be CRO, while London-based Jeff Kabel, chairman emeritus of the International Steel Trade Association (ISTA), will be CTO. Dubai-based Iain Hunter, a former Wyelands Bank chief executive, will be CGO. The new chief financial officer, and also GFG Alliance interim CFO, is Dubai-based Deepak Sogani, former managing director for metals & mining at Essar Capital Services. Current Liberty cfo V Ashok is stepping down at end-May for personal reasons.

Both CRO and CTO roles are independent interim roles brought in for a special purpose to restructure and refinance the group. The roles are paid fees and are not employees of the company.

Adam Smith Germany

UK Steel urges government to extend steel safeguards

UK Steel is calling on the UK government to extend steel safeguards beyond their current June 2021 expiry date, the UK steel association told S&P Global Platts on May 5.

The UK has had the safeguards in place as part of the EU since 2018 and then transitioned them into UK law in January 2021 to avoid trade diversions as US introduced steel tariffs.

“We are confident the EU and US will retain their equivalent measures. If the UK unilaterally removes its measures, it will open our market to import surges as the sector recovers from COVID-19, and crucially at a time when our exports to the EU and US will still be subject to tariffs and quotas,” the association stated.

According to the association, before the introduction of the EU steel safeguards, UK imports of steel went up by 25% between 2013 and 2017, but because of the continued problems of global overcapacity, and the increased use of import restrictions around the world they expect that it is almost certain the increase will resume if the UK unilaterally removes measures.

The association pointed out that as the measures allow for tariff-free imports equivalent to 111% of historic levels, with further relaxations every year, this could give enough rooms to import some products if needed.

“In general the UK quotas were designed to allow for an average 61% import penetration level of 2015-17 demand levels. This will have been liberalized to allow for import penetration levels of closer to 70% of 2019 demand, and 90% of 2020’s severely reduced demand levels. Even with a modest recovery next year we would expect further liberalized quotas to allow for 80-85% penetration levels,” the UK Steel Policy Manager explained to Platts on May 5.

ISTA, the UK International Steel Trade Association, is against the continuation of the Steel Safeguard Measures. “Here in the UK, as UK producers cannot produce enough material in most product category groups to service the independent steel service centers and stockholders, without imports over the last twelve months many [service centers] may not have survived,” an ISTA spokesman said. “Service centers had to rely on imported material, mainly from outside of the EU, as European mills have cut back severely their own production over the last year.”

Some products were very close to extinguishing all their allocated quota very quickly such as the large welded tubes, hollow sections and organic coated steel (OCS) products.

Domestic market sources said some large service centers have mixed views as most of them, although they have challenges finding material, are making good profit margins and benefiting from high prices.

The UK government is expected to determine whether to maintain the safeguard by June, but it is understood that a date has not been decided yet. For the UK Safeguards, the Trade Remedies Investigations Directorate (TRID) will be making an independent determination, expected possibly next week. Then this recommendation goes to the Department for International Trade and the Trade Secretary will accept or reject it.

For the EU Safeguards the decision is made by the European Commission and will likely be finalized after the UK, or at least later than TRID’s determination as is expected in July.

“While the decisions are separate, the EC’s decision will impact the UK’s ability to export to the EU so a situation where the EU extends the measure but the UK does not would be detrimental for the UK steel sector,” the UK Steel Policy Manager added.

According to worldsteel data, the UK produces 7.2 million mt of crude steel a year, around 71% of the UK’s annual requirement.

A DIT spokesperson when reached by Platts on May 5 said that they are working to protect the steel industry and trade remedies are an important element of the international trade framework:

“The Trade Remedies Investigations Directorate (TRID) is currently reviewing steel safeguard measures on 19 steel product categories that we transitioned to ensure they reflect the requirements of the United Kingdom. The review will conclude before the measures expire at the end of June. TRID has yet to conclude its analysis and as such it is not appropriate or possible for it to speculate about the outcome of the review at this stage.”

— Annalisa Villa

Turkish steelmakers demand acceleration of EU dumping investigation

Drawing attention to the European Commission’s recent anti-dumping duty decision against Turkish HRC, Turkish Steel Producers’ Association (TCUD) has demanded the acceleration of the AD investigation opened by Turkey against HRC imports from the EU.

“Considering EU’S efforts to restrict Turkish HRC exports to the region by protection measures, it is important to conclude the ongoing anti-dumping investigation against HRC imports from EU, to protect the Turkish steel sector’s competitive power,” TCUD said at a statement sent to S&P Global Platts May 5.

Turkey officially started the dumping investigation of HRC imports from the EU and South Korea with a presidential decree published in the country’s official gazette Jan. 9, just two days after the EU imposed provisional AD duties on imports of HRC from Turkey. The EC on April 23 said it decided to impose definitive AD duties of 4.7%-7.3% effective July 1.

“Even if it is decided not to extend the EU protection measures [quotas] which will expire at the end of June, EU will continue to protect its steel sector with the latest anti-dumping duty decision,” TCUD said, noting that Turkey should take counter measures under these circumstances.

According to the latest TCUD data on May 5, steel imports into Turkey rose by 15.7% on year to 3.9 million mt in the first quarter, while Turkish mills’ steel exports rose 2.8% in that period to 4.2 million mt, amid ongoing trade barriers in their main export markets, the EU and the US.

Steel consumption in the country increased by 15.8% on year to 8.9 million mt in Q1, while Turkish mills’ crude steel output totaled 9.8 million mt in that period, up 9.5% on year.

— Cenk Can

US HRC LME April-June spread in steep contango

The London Metal Exchange’s US hot-rolled coil forward curve saw gains for all but the two-month contract the week ended April 30, as the April-June spread formed a steep contango. Full-week data was available on May 4 following the UK bank holiday the previous day.

The April-June spread’s contango widened to $150.50 to close out the month, up from $133 the week prior. While the remainder of the forward curve stayed in backwardation, all contracts settled above $1,000/st, suggesting elevated HRC prices could persist through the first half of 2022.

The April contract rose by $6.50 to $1,389.50/st, settling $82.50 below the latest daily Platts HRC spot price of $1,472/st.

HRC prices were expected to continue moving higher in the near term as the two- and three-month contracts remained above the daily Platts spot price.

The May contract dropped by $12 to $1,502.50/st, while the June contract ended the week $15 higher at $1,540/st. As expectations of a possible end to the price rally continued to shift further ahead, the September contract also rose by $9.50 to $1465/st.

The 12-month contract saw the largest increase over the week, moving $75 higher to $1,181/st, while the 15-month contract gained ended the week $24 higher at $1,030/st.

The contract’s weekly trading volume totaled 2,690 st the week ended April 30, up slightly from 2,620 st the week prior. The contract has traded a total of 608,970 st since its launch in March 2019.

Spot prices in the physical market remained on an upward trajectory amid ongoing supply constraints. HRC prices gained over $100/st in April and continued to reach new all-time highs after stalling near $1,350/st from late March to mid-April.

— Ingrid Lexova

Port of Rotterdam, TK, HKM explore hydrogen imports

German steel companies Thyssenkrupp Steel and HKM have partnered with the Dutch Port of Rotterdam to explore renewable hydrogen imports for use in the production of green steel, the companies said in a joint statement May 4.

The steel manufacturers will require increasingly large volumes of hydrogen in the production process as they move from using coal as part of the transition to renewable feedstocks and energy supply. Both companies have imported coal and iron ore via their own terminal in Rotterdam, then shipping to blast furnaces in Duisburg, Germany, by barge and rail, the statement said.

The companies are to investigate hydrogen imports via the Dutch port, as well as a possible pipeline corridor from Rotterdam to Duisburg.

“Vast imports of hydrogen are necessary if Europe and Germany want to reduce CO2 emissions and become climate-neutral by 2050, while maintaining its strong industrial backbone,” the companies said.

Platts last assessed the cost of producing hydrogen via alkaline electrolysis in the Netherlands (including capex) at Eur3.55/kg April 30. PEM electrolysis production was assessed at Eur4.54/kg, while blue hydrogen production by steam methane reforming (including carbon, CCS and capex) was Eur2.05/kg.

Blue hydrogen

Rotterdam is also establishing a CO2 transport and storage system, which could be used to store CO2 captured from the production of hydrogen from natural gas as part of the “H2morrow steel” project, in which Thyssenkrupp Steel is a partner.

The Port of Rotterdam, along with partners Equinor, BP, Shell, ExxonMobil, is also exploring the production of blue hydrogen — produced via steam methane reforming with carbon capture and storage.

Under the H-vision initiative, a first hydrogen production plant with a capacity of approximately 750 MW is expected to be completed by late 2026. A second hydrogen plant can increase the total capacity to over 1.5 GW.

The main focus of the H-vision program is the production of hydrogen using natural gas and refinery fuel gas, while the CO2 that is released during production will be captured and stored in depleted gas fields under the North Sea.

H2 steel applications

The Energy Transitions Commission said in a report published April 27 identified the steel industry as an area where hydrogen application is likely to develop over the longer term “as the relevant application technologies develop and capital assets are replaced.” By 2050, hydrogen could account for 50% of the final energy demand in the steel sector, it said.

The report – “Making the Hydrogen Economy Possible” – said in the shorter term, hydrogen could be co-fired with coal in blast furnaces.

“Using hydrogen as the reduction agent rather than coking coal may increase steel prices by 40%,” it said, but added that the “green consumer premium” would be much less significant in finished products, adding less than 1% to the cost of a vehicle built with 1 mt of steel.

In addition, the ETC highlighted that constraints on the location of hydrogen production facilities could lead to changes in optimal locations for steel plants. Industrial clusters around a set of linked hydrogen infrastructure would be one such model, the Commission said.

— James Burgess

Fundamentals support strong iron ore prices in 2021: Platts Analytics

Iron ore prices have risen to record highs in recent weeks, largely because supply has not been able to keep pace with demand in China, where crude steel production has grown by 30% over the past five years.

Unless China drastically cuts steel output – which seems unlikely as Q1 output rose 16% on year and April was another strong month – or global iron ore supply increases significantly, it is difficult to see what will cause benchmark prices to retreat to consensus views of around $100/mt in the next 12-24 months.

Iron ore prices are currently hitching a ride on the back of soaring Chinese steel prices and margins, with news of further output reductions for environmental reasons boosting an already overheated sentiment. China’s domestic hot-rolled coil margin hit a record $177.80/mt on April 25, according to S&P Global Platts Analytics. Domestic HRC prices were Yuan 5,750/mt ($888.50/mt) the same day, marking a 7% climb over April.

Looking into May, the monthly Platts China Steel Trade Tracker shows the market expects steel prices to continue rising, supported by falling steel inventories and robust orders.

Platts China Steel Trend Tracker – May 2021

(1 – Decrease to 5 – Increase)

| Prices | 4 |

| Inventories | 2 |

| Orders | 3 |

| Production | 4 |

Push-pull factors

Often it is not clear whether steel prices are being pushed by raw materials prices, or whether raw materials prices are being pulled by finished steel prices.

At the moment, it seems to be the latter. Since 2010, iron ore and steel prices have generally trended in the same direction. An exception was 2018, when the two prices decoupled. Why?

Iron ore prices were rangebound at moderate levels for much of that year, failing to enjoy the benefits of rising steel prices. China’s iron ore import volumes were slightly lower in 2018 than they were in 2017 – 1,064 million mt versus 1,075 million mt – but were more than adequate at a time when the country was removing steelmaking capacity as part of its supply-side reform agenda. Downstream, property construction demand was extremely strong in 2018, supported by shanty town renovation, while Beijing’s “more active” fiscal policy saw more local government bonds going into infrastructure.

Strong steel prices as a result of capacity removal incentivized new steelmaking facilities under China’s steel capacity swap program. In 2019, China added 40 million mt/year of capacity, much of which was in effect net capacity as the new steelmaking facilities were replacing ones that had been offline for several years. The capacity increase slowed in 2020, but Platts Analytics expects around 28 million mt/year of new capacity to be commissioned in 2021.

China produced 1,053 million mt of crude steel in 2020, around 245 million mt more than it produced in 2016. This is despite some 100 million-150 million mt/year of steel capacity – along with an additional 140 million mt/year of induction furnace capacity – over 2016-2020 (the 13th five-year plan) being removed as part of the country’s supply-side reform.

Capex cuts, value over volume, keeping supply tight

Meanwhile, iron ore majors and other resources companies in Australia were slashing capex and exploration spending over this period. The focus was on maintaining the quality of core assets, delivering more cash back to shareholders and keeping a firm grip on the financial reins. “Value over volume” was the mantra.

Looking at where iron ore prices are currently, the iron ore majors and their shareholders would argue that this was the correct policy. But producers did not anticipate how quickly steel output would grow. Rio Tinto and BHP expected China to reach annual steel production of 1 billion mt sometime over 2025-2030 – but China achieved this in 2019.

Last year, China imported 1,170 million mt of iron ore, up around 146 million mt, or 14%, compared with 2016. Australia’s total iron ore exports in 2020 were 897 million mt, just 89 million mt, or 11%, higher than in 2016. Brazil’s exports last year were 396 million mt, compared with 374 million mt five years earlier, with production over the five-year period impacted by the tailings dam tragedy and subsequent recovery.

Projected iron ore supply is routinely overestimated, with Australian exports yet to hit levels that were expected by many forecasters to have been achieved 2-4 years ago. Supply this year depends largely on Vale’s ramp up in Brazil, while tie-in work and commissioning at new replacement mines in Australia’s Pilbara region could take longer than projected.

On the steel side of the equation, only a significant reduction in Chinese production – and subsequent drop in demand for raw materials – could take the heat out of iron ore prices. Smaller output cuts here and there merely spark a rise in finished steel prices, taking iron ore prices along for the ride given the current supply-demand scenario.

Steel prices could be slightly softer in the second half of 2021 on the back of some downstream resistance to higher prices and tighter credit conditions. This could see iron ore prices climb down from elevated levels of late April. Overall, however, iron ore prices look set to remain extremely strong.

— Paul Bartholomew

Czech government probes Liberty Steel Ostrava’s financial conduct

The Czech government has called an extraordinary meeting of steelmaker Liberty Ostrava’s supervisory board for May 5 with a Czech ministry representative on the board tasked with carrying out “financial checks” at the company, Minister for Industry and Trade Karel Havlicek said in a post-Cabinet press conference May 3.

Havlicek’s comments came amid government and union concern that the Czech Republic’s biggest steelmaker will be damaged amid moves by owners Liberty Group and GFG Alliance to resolve the multinational steelmaker’s wider financial problems. Those worries escalated when one million carbon emission allowances owned by Liberty Ostrava were sold to sister Liberty Group mill Galati in Romania on April 30 in spite of Czech Prime Minister Andrej Babis saying he had been promised this would not happen.

Havlicek said his ministry’s representative on the supervisory board will “take responsibility for financial checks” at Ostrava Liberty. In particular, the representative will check that the proceeds from the sale of the carbon emissions are returned to the Ostrava company by the promised deadline of May 6, Havlicek added.

“The proceeds [from the emission sale] should be used only for the development of the Ostrava plant or for increased wages for the Liberty Ostrava workers,” Havlicek explained during the press conference, adding that the government’s opposition to the emissions sale had helped prevent the mill’s owners from fulfilling their original intention of selling 3.0 million carbon allowances.

But Havlicek also admitted that the government has little influence over Liberty Steel and its owners. “It’s a fully commercial company with no state shareholding,” Havlicek said during the press conference. The ministry representative on the supervisory board was a concession made when Liberty Group took over the Ostrava mill in 2019.

Unions at Liberty Steel Ostrava, also represented on the supervisory board, have called a for meeting May 5 to discuss action aimed at “paralyzing the plant.” They have been on strike alert since April 13 with their main fear that the Ostrava mill’s 5.0 million emission allowances, earmarked to be cashed in for plant modernization, will be diverted by mill owners for other purposes. Spokesman for the main KOVO union at the mill, Peter Slanina, told S&P Global Platts April 30 that a strike might be called at the upcoming meeting but other options were preferred.

GFG Alliance said in a statement April 30 confirming the emissions allowance sale that the proceeds would be returned to the Ostrava mill. GFG Alliance said in a further statement May 5 that profits of Eur10.05 million from the allowance sale will be used to give Liberty Ostrava workers a one-time bonus of Eur505 each by the end of this week to mark the steel mill’s 70th birthday. “The remainder of the proceeds will be used on future investment projects at Liberty Ostrava,” the statement added.

Minister Havlicek did not say May 3 whether financial checks will be widened beyond the return of the carbon emission proceeds and their future use.

Unions and some government ministers have suggested wider checks are warranted. Minister of Culture and member of parliament representing Ostrava, Lubomir Zaoralek, said in a statement April 30: “The transactions of the owner of this company [Ostrava Liberty] are the subject of investigations in several countries. We do not know where Koruna 2 billion ($93 million) made available in 2020 to help the [Ostrava] steelworks which was guaranteed by the state through the state export guarantee and insurance company (EGAP) disappeared to,” Zaoralek said, adding that special state financial fraud squads and prosecutors should investigate.

A Liberty Steel spokesman declined to comment May 5 to S&P Global Platts “on statements made by unions and a number of members of parliament in recent days.”

— Chris Johnstone

GFG conducts ‘due diligence’ with Whyalla financiers

Sanjiv Gupta’s GFG Alliance says it is in advanced due diligence to choose a new financier for its steelworks in Whyalla, according to comments given to the Financial Times. An application to wind up the operation will have a first hearing in court later this week, Kallanish notes.

The Whyalla steelworks was bought by GFG alliance after previous owner Arrium went bankrupt in 2016. Surging steel prices however mean that the plant should now be profitable.

The site has nevertheless been caught up in the controversy over GFG’s financing. The company was encouraging suppliers to sign up to its financing scheme with Greensill Capital, whereby they could receive money early if they accepted a reduction in payment, which reports suggest was around 8%. Suppliers however had already begun to voice dissatisfaction over the extended payment terms that the plant was offering.

The collapse of Greensill has prompted Credit Suisse, which had funded Greensill, and Citibank which is acting on its behalf, to request that GFG’s operations in Australia are wound up and sold off to repay Greensill’s creditors. Now GFG is trying to secure financing to keep the business running to head off attempts at winding it up.

It remains uncertain what role the Australian government may play in the process. An AUD 50 million ($38m) credit facility for use in investing in upgrading equipment at the plant remains unused, but the government has stated that the funds cannot be used to settle debts. The steelworks is a key employer in the city of Whyalla.

European scrap seen increasing €40

European scrap prices are about to increase significantly as merchants are beginning to ask for €20-40/t hikes in Italy, France and Germany, depending on grade and availability, sources say. The market is being pushed by the latest scrap price increase announcements from large steelmakers for May.

One northern European steelmaker is said to be offering a month-on-month increase of €40/t ($48) for the high-quality grades of new arisings E8 and shredded E40, and a €30/t hike for lower, older grades. The tight supply of E8 and E40 in northern Europe, together with producers’ strong order books, are boosting the need for scrap. However, E8 and E40 grades are in high demand also in southern Europe and particularly in Italy.

Thanks to April’s high prices and fears of declines, many European scrap sellers sold as much as they could last month, with the result of depleting their stocks. This month in Italy, France and Germany E8 is seen reaching €410/t for the mixed grade and €440/t for the high grade. E40 is also forecast to go over the level of €400/t delivered, sources say.

Since scrap values started to increase this year, prices in European countries are aligning, Kallanish notes.

Natalia Capra France