The 25% tariff on European steel exports to the US will have limited impact, as many products cannot be easily replaced domestically, sources said Thursday.

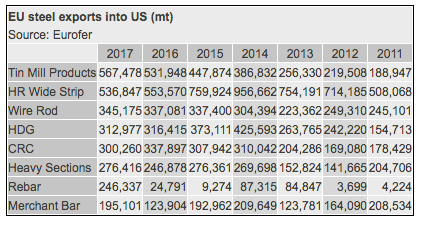

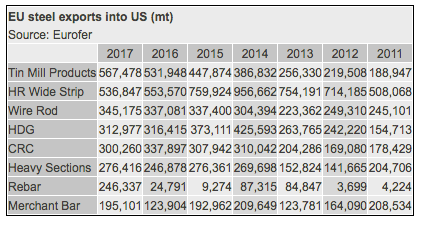

The US imported 3.2 million mt of finished steel products from the European Union in 2017, making it the region’s second-largest export destination after Turkey.

The most exported product was tinplate, a product not easy to replace from local sources in the US as suppliers are limited. Tata Steel is the largest source of foreign tinplate, selling 272,000 mt in 2017 primarily to packaging companies. Sources suggested Tata supplies drawing-quality grades that can save can-makers around five cents per can, while US producers have largely moved out of the product sector in recent years.

Steelmakers also pointed to the US automotive sector, which imports a large proportion of the 1.2 million mt of coils sold into the US last year. “Our customers are realizing that this will be a big problem for auto, indirect auto, engineering high-strength wide steel and packaging steel customers. They are all completely reliant on Europeans,” one mill source said.

Another mill source said that even where the grades are produced in the US, end-users may struggle to acquire the volume they require from the domestic market. “A lot of the US grades they make, they are already at maximum capacity,” the source said.

A third mill source noted the limited impact on European sales to the US after President George W Bush implemented Section 201 tariffs in the early 2000s. “Last time there was a tariff, Europeans just said ‘Sorry, the price is increasing by the tariff,’ and nothing happened,” he said.

The impact is expected to be more serious for long steelmakers, with the likes of Megasa in Portugal sharply increasing their US-bound sales of rebar to 145,000 mt in 2017. Sources said commodity-grade products such as these are likely to be unworkable with a 25% tariff.

But the biggest concern for most is the likely redirection of trade from the US. “It’s plain and simple, only in flat products there is 12 million mt shipped to the US, of which eight million is non NAFTA … that could be coming to Europe from tomorrow,” one mill source said.

Peter Brennan, PLATTS