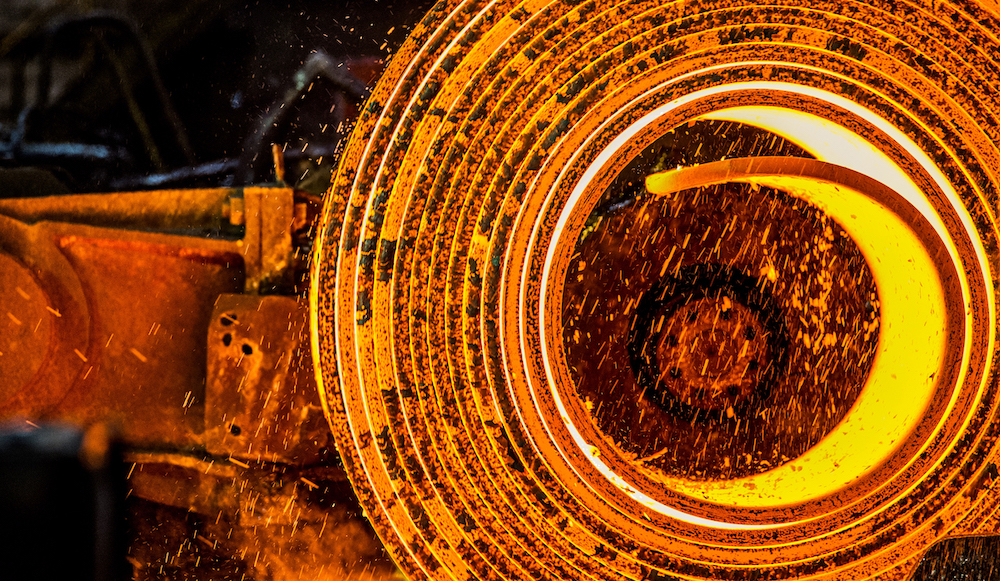

The majority of the European producers of hot-rolled coil withdrew offers from the market on Jan. 19, preparing to increase prices.

Concerns have been growing among buyers that a lack of demand recovery and the return of idles blast furnaces into operation could put an end to the upward trend settled in the European market since the middle of December.

Multiple market participants said that the steelmakers planned to target Eur800/mt ex-works Ruhr in Northwest Europe and similar prices in the rest of the EU.

Platts assessed hot-rolled coil in Northwest Europe stable at Eur740/mt ex-works Ruhr Jan. 19.

Market participants reported tradable value at Eur730-Eur760/mt ex-works Ruhr.

Trading activity has been limited, as buyers have preferred to avoid putting material in stocks and booked only minimum required volumes. Such an approach was caused by the concerns among buyers that the price rise might not be sustainable.

“The market lacks realistic price indications,” a service center said. “We try to buy bare needed minimum as I do not believe that the current price trend is sustainable.”

The coil price recovery has been mainly been driven by restocking and reduced availability. However, end user demand has not improved and the return of the volumes to the market threatens the bullish price trend.

A number of European steelmakers had stopped blast furnaces in 2022 in an attempt to balance supply and demand and therefore support the coil prices. In January, ArcelorMittal Spain and US Steel Kosice in Slovakia confirmed the return of the capacities, and as a result European buyers were concerned that the increased production would put an end to the price rise.

European steelmakers claimed that they had either fully booked the first quarter rolling coil or had limited volumes for March.

“Production increase it will be a price killer,” a trader said. “This bull run will not last enough to make a profit.”

Some market participants, however, believed that the lack of competitive import and balanced approach of the mills to capacity restart would still allow the coil price recovery.

“Prices will continue to rise despite stable demand,” a Germany-based distributor said. “Mills return capacities with caution, so they should not disrupt the positive trend.”

Platts assessed domestic prices for hot-rolled coil in South Europe at Eur730/mt ex-works Italy on Jan. 19, up Eur10 on the day. The assessment was based on achievable prices heard at Eur730-Eur740/mt ex-works Italy.

Platts is part of S&P Global Commodity Insights.

— Maria Tanatar