European domestic steel sections prices softened week on week on May 3, as sources continued to report low demand.

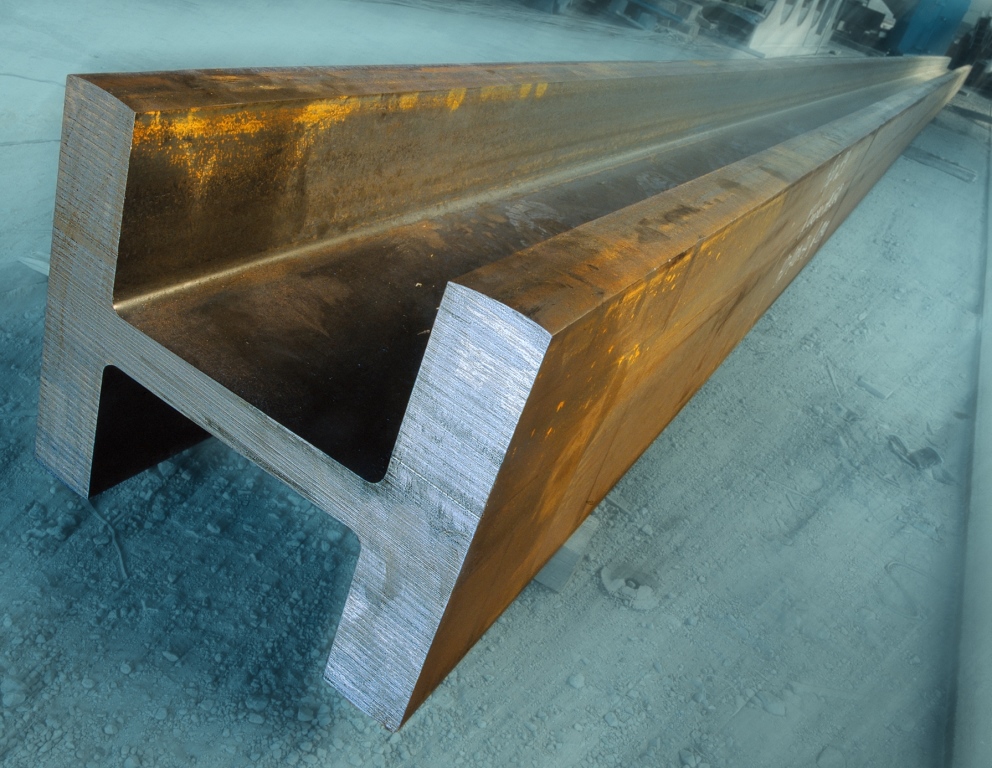

Platts assessed European medium sections (category 1, S235 JR) down Eur5/mt on week at Eur925/mt delivered.

“Prices still seem to be under downward pressure [due to weak demand]. Because of climatic and economic conditions that are not supporting construction activities, projects are on hold,” one Benelux-based distributor source said. The source put a workable level for beams at around Eur920/mt delivered.

Another distributor source in the Benelux region put a workable level for category 1 medium sections around Eur920-Eur930/mt delivered.

“Demand is good for beams… weather is much better now. It was raining during April but it is sunny now so I think projects will restart,” he said, adding that inventory levels at end-consumers seemed low so if projects started again demand might pick up which might support prices.

Meanwhile, Platts assessed Northwest Europe Rebar flat on the week at Eur680/mt ex-works on May 3.

One distributor source in the Benelux region put a workable level for rebar in the domestic market at around Eur705/mt delivered.

“Demand is still weak,” one seller source said, and indicated a possible workable level for rebar in the domestic Northwest European market at around Eur695-Eur705/mt delivered, but noted that workable levels could have been clearer if buyers were placing any orders. “I heard that prices from Spain [for rebar] were already lower. But only a few would accept the [lower] quality material,” he said.

One European trader indicated a workable level for rebar in the domestic Northwest European market to be around Eur685-Eur695/mt delivered.

Platts is part of S&P Global Commodity Insights.

Author Rabia Arif