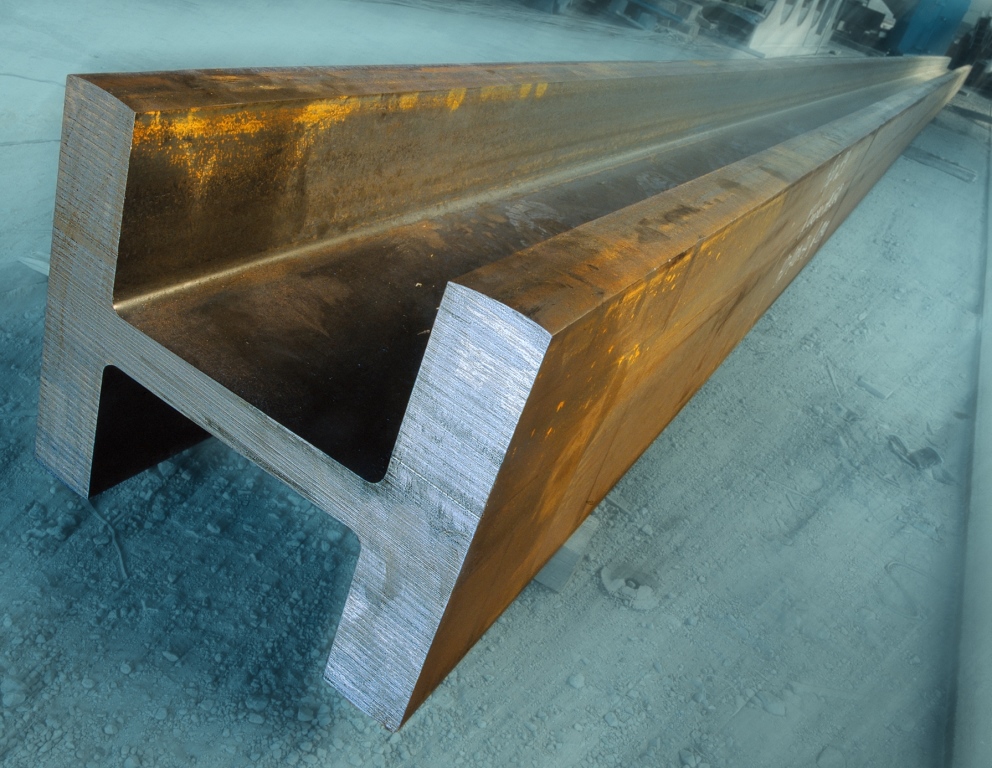

European domestic steel sections market participants expect demand to pick up in the near-term while prices stayed stable at elevated levels Feb. 24

Platts’ European medium sections price (category 1, S235 JR) was assessed at Eur715/mt delivered Feb. 24, stable on week.

One European mill source expects demand to pick up in the near-term, with a possible uptick in prices as well.

“Demand is picking up obviously. Especially with what’s happening with scrap in Turkey, not sure what will happen with scrap in Europe, but demand is coming back.”

The source noted that the market needs to observe what is happening with international scrap prices before gaining any clarity on future prices.

“Demand has been stronger than it has been in the past few weeks,” he told Platts. “I think future price trends will depend a lot on domestic scrap prices and it’s too early to speculate on that. We need a couple of weeks to understand scrap and demand levels. There is room for prices to move up but today is too early to say that.”

The source put a tradable value for medium sections at Eur715-Eur720/mt delivered.

Turkish scrap import prices jumped another day amid strong workable levels. Platts assessed Turkish imports of premium heavy melting scrap 1/2 (80:20) at $450/mt CFR, up $5/mt on day.

One distributor source in the Benelux region noted that the market was observing good demand: “We had a little bit of winter for a couple of weeks, but the weather is better now, which is good for construction.”

The source cited a tradable value for medium sections at Eur720/mt delivered Benelux.

Another distributor source put a tradable value at Eur710-Eur720/mt delivered Benelux.

— Rabia Arif