The European steel industry still has room for consolidation within its ranks, the former director general of European steel distribution association EUROMETAL said Feb 18, a day after ThyssenKrupp said it had pulled out of sales talks for its European steel unit with Liberty Steel.

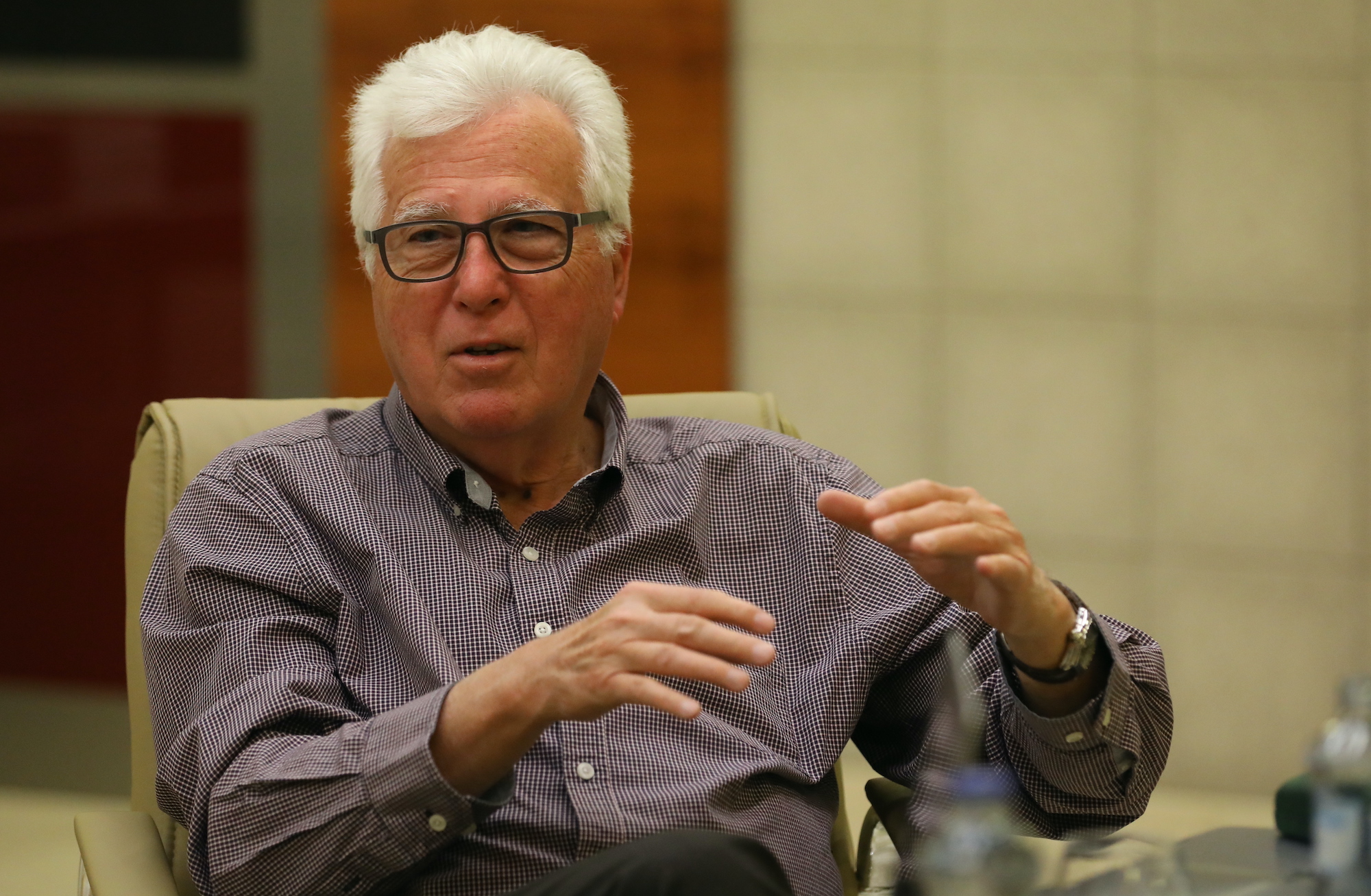

“Whatever is the outcome of the ThyssenKrupp deal, the fact remains, and this is the most important lesson of the last months, there are in EU at least four steel groups searching for synergies and economies of scale, eventually by consolidation,” Georges Kirps, the former EUROMETAL director general, told S&P Global Platts in an interview. “These are Tata Steel Europe, SSAB, Liberty Steel and TK Steel, meaning that no less than 25% of EU steel output are exploring consolidation trails. So, the consolidation book remains largely open,” he said.

ThyssenKrupp said Feb. 17 that it had ended talks for selling ThyssenKrupp Steel Europe to Liberty Steel, focusing on restructuring the unit on its own. The German company said the decision because the two parties could not agree on a valuation for the steel unit.

Liberty had submitted an updated, non-binding offer earlier this year to acquire ThyssenKrupp Steel Europe. Thyssenkrupp CEO Klaus Keysberg has said UK-based Liberty was the only buyer considered.

ThyssenKrupp, in a statement, said there were differences over “ideas about the corporate value and the structure of the transaction were far apart.”

Nevertheless, Liberty said it was keeping the ‘‘door open“ to Thyssenkrupp after that the German steelmaker ended the sale talks.

‘‘We note the announcement from ThyssenKrupp,” Liberty said in its own Feb. 17 statement. “Discussions have been suspended at this stage due to differences in pricing expectations. Liberty remains confident that it has put forward the only long-term sustainable plan for ThyssenKrupp’s steel business and we will continue to engage to seek to eliminate the valuation gap in due course.“

Market participants made their judgement on the failed merger, with one source, at a German distributor, calling ThyssenKrupp’s withdrawal a “good decision.”

The source added that it was unlikely Thyssenkrupp would be amenable to further negotiations.

“A spinoff is an option,” he said.

A second distribution source said he believed not fulfilling a deal might work out for both [parties] because “they want money at this price level. But I believe that somehow consolidation will be necessary in the near future.”

The Liberty-ThyssenKrupp deal is the second European steel deal to fall through in a matter of weeks, after Swedish special steel producer SSAB pulled out of efforts to buy Tata’s Dutch assets.

While it is not clear what lies ahead for ThyssenKrupp, the company can still potentially enter into deal, though analysts said it was unlikely for the near term.

At the turn of the year, there was the possibility of two different transactions (SSAB/Tata and TKA/Liberty), both of which have ended discussions,” Jeffries analysts said in a Feb. 17 report. “TKA could potentially still entertain M&A but we don’t see any logical partners in the near term. Considering EC concerns around market shares in automotive and packaging, we view it highly unlikely TKA would re-engage discussions with Tata. Previously, we had expected an update by March around the future for Steel Europe but this seems to narrow down the possibilities. Ultimately, TKA could still consider a spin out of the business, but for now, it looks like Steel Europe will remain in the portfolio.”

— Annalisa Villa, Amanda Flint