Following high demand for sections in the first half-year, order bookings had markedly decreased by the end of September, Salzgitter observes.

In H1, demand was driven by restocking, but also by speculation about further price hikes. Since late summer, sections mills have had increasing difficulty securing utilisation, Kallanish learns from Salzgitter’s nine-month report. Notably, the company points out that real demand has actually not changed overall.

Salzgitter attributes this to speculative buying patterns, both of the stockholding steel distributors and of end consumers. “Many had assumed that the available volumes would become increasingly scarce, making it difficult to secure supplies, and that prices would continue to rise, prompted by stable demand,” it writes in the report.

This scenario did not play out, however, Salzgitter concludes. The reductions in inventory anticipated in August did not take place, and have not occurred in September either. Instead, inventory turnover remained at a weak level, with all manufacturers producing again after downtime in the summer, and delivering large volumes. This resulted in rising inventory levels at stockholders.

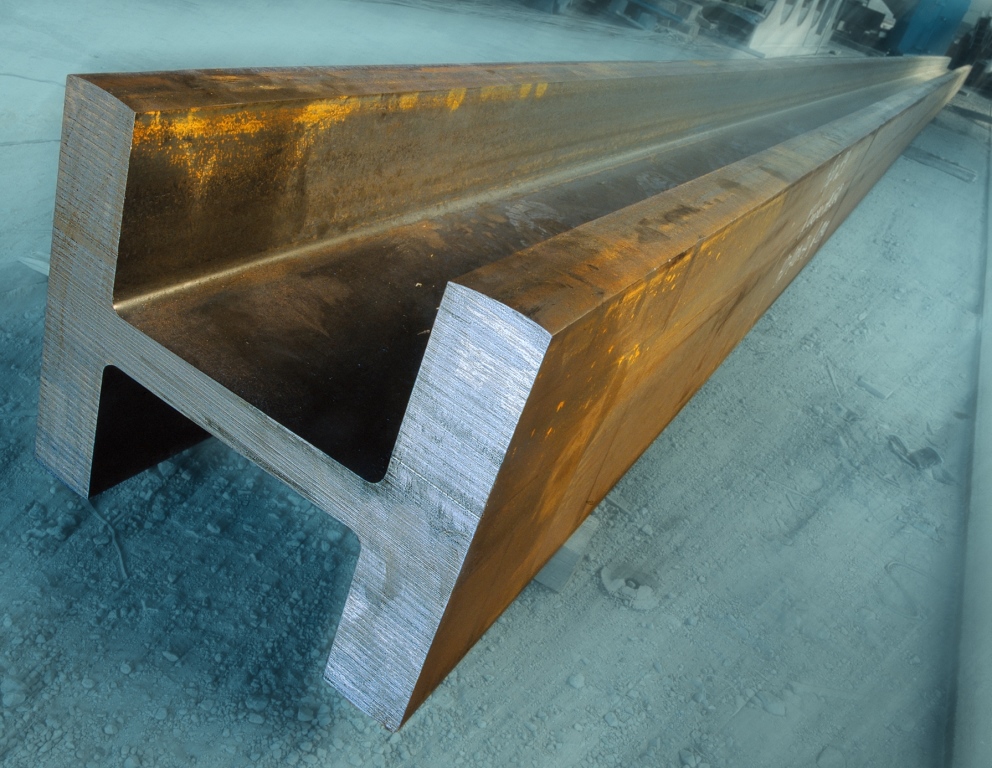

At Salzgitter, sections are combined in a business unit with heavy plate. The unit delivered 458,000 tonnes in total in the third quarter and 1.499 million tonnes in the first nine months. It lifted its revenue to €503 million ($576m), from €306m in Q3 2020, and returned to an Ebit of €19m, against a loss of €39m a year earlier.

Christian Koehl Germany