Despite import quotas for hot-dip galvanized steel sheet imports filling up this past week, prices remain under pressure in line with broader weakness in the flat steel market.

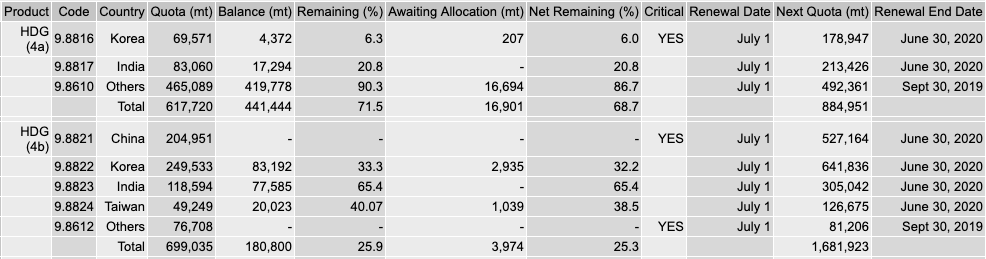

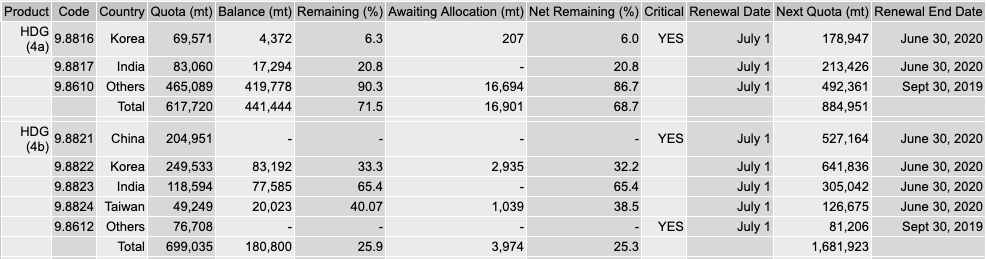

In product category 4a (HDG products mostly used in construction and industrial applications) the quota for Korean material — product code 09.8816 — has reduced to critical status of just 6.3% or 4,371 mt. Including material pending allocation and clearance into free circulation of 207 mt, this reduces further to just 6.0%, or 4,175 mt of the original 69,571 mt quota.

When a quota reaches critical status, importers are asked to deposit in advance the 25% tariff with customs authorities before importing quota-targeted products.

This raises financing costs and may deter importers and encourage warehousing or stockpiling of un-cleared material at ports while importers await quota renewal.

Once this remaining 6% balance is filled, which at the current rate of importation of approximately 590 mt/day on average in April is, likely to be within the next seven days, Korean imports can be cleared under the “other countries” quota.

European Commission rules state that when a named country has exhausted its own import quota in the third quarter of a quota year, then that named country may import material under the other countries quota in the fourth quarter of the same year provided there is a balance available.

The 4a other countries quota renewed on April 1 and still has a large available balance of just under 420,000 mt.

In product category 4b – galvanized products mostly used in Automotive applications, the initial quota of 204,951 mt for China was filled back on March 6 and will not renew until July 1.

The 4b other countries quota, having been filled in just three days in early February renewed on April 1 and allowed for 76,707 mt of additional imports.

The backlog of HDG material was sufficient to fill this renewal quota by April 4 and sources said that this was comprised of a mixture of origins with Turkish and Chinese material featuring heavily.

Traders have told Platts that they now believe large uncleared balances already exist at European ports, with 4b HDG being warehoused on an uncleared basis pending the next quota renewal on July 1.

“The galvanized quotas are full and yet prices aren’t higher … there are large balances of material waiting the next quotas already at ports, maybe 200,000 up to 500,000 mt,” a UK trader told Platts this week.

Despite the apparent aggressive subscription of the HDG quotas, especially in 4b for automotive uses, prices however remain under pressure.

One German distributor told Platts “prices in galv are lower despite quotas being filled, this is a crazy situation as the mills were all expecting higher prices with the quotas being done.” The source added further that automotive clients were taking less than their agreed “call-off amounts” each month and so the mills were having to cut prices to move material into the spot market.

Commenting on the quota situation a western European mill source told Platts “Its just a matter of time for prices to move higher” adding that he saw tradable value at Eur610/mt ex-works Ruhr with lead times from domestic production holding steady at seven weeks.

A European mill source said that he saw tradable value in HDG lower at Eur590/mt ex-works Ruhr adding “the automotive business is broken … I see the spread of HDG over hot-rolled coils reducing from current levels of Eur100/mt to around Eur80/mt in the coming months.”

The historical spread of HDG/HRC can be viewed as a barometer of automotive demand versus general commodity grade steel demand. In 2018 this trended lower over the course of the calendar year, from Eur128/mt in early January to Eur88.5/mt in November, reaching the lows during the peak of the WLTP testing issues that blighted European car manufacturers.

In 2019 the spread has traded between Eur89/mt and Eur104/mt and was last seen at Eur100.40/mt on April 12.

A German service center source said that they were seeing some automotive buying but only from customers who had cut back volumes in the third and fourth quarters of 2018. “Those guys are now seeing less metal in their supply chains and are now back buying to top up the chain, which is indeed real business, but overall significant volumes are still missing [from order books],” he said.

The source added that they saw tradable value at Eur595-600/mt ex-works Ruhr.

A central European mill source said he saw tradable value lower at Eur580/mt ex-works Ruhr adding, “the galv market is a disaster, construction demand is OK but automotive is terrible. There is so much metal around it is very easy to buy”

The Platts TSI North European HDG Coil/N.Europe domestic Ex-Works, weekly assessment base price for DX51D gained Eur2/mt to settle at Eur600/mt on Friday April 12, its lowest price level since October 2017.

— Len Griffin