The gap between increasing Polish steel consumption and stagnant domestic production is widening, at a time when the massive looming energy transition will require more steel for projects in Poland, according to Polish Steel Association (HIPH) president Stefan Dzienniak.

ArcelorMittal’s Krakow hot-end, shut down for good in 2020, was the first victim of competition from countries beyond Poland’s eastern borders. When demand rebounded strongly in 2021 after the initial Covid-19 pandemic shock, the required domestic supply was therefore not there to meet it, Dzienniak said at this week’s European Economic Congress in Katowice monitored by Kallanish.

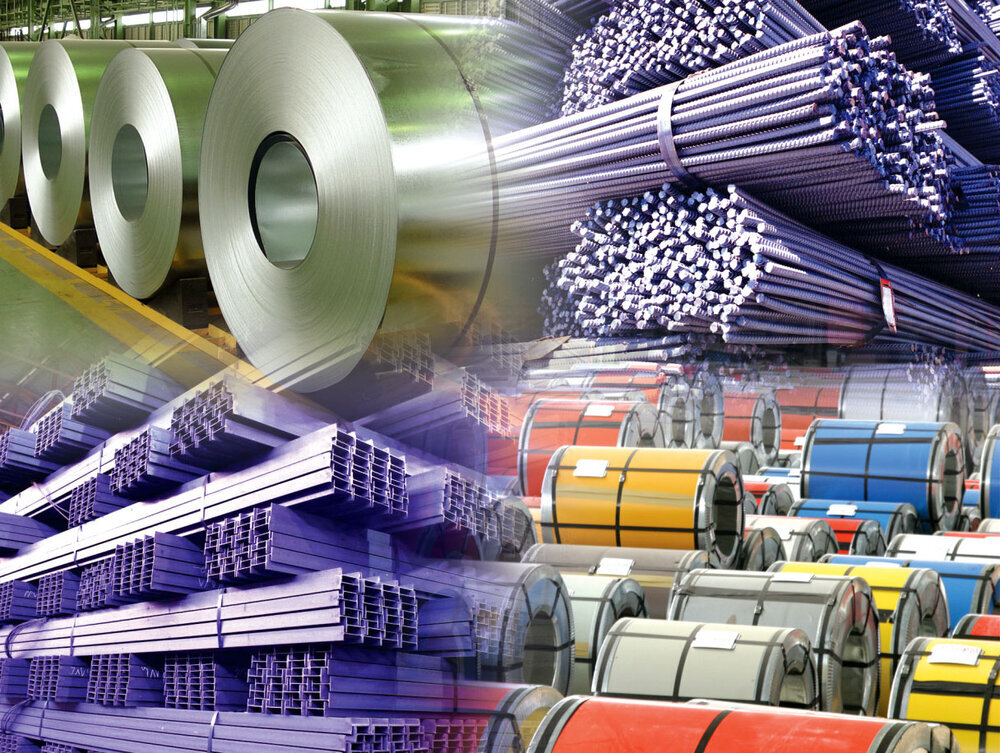

Polish apparent steel consumption reached 15.3 million tonnes in 2021, double the tonnage of 2004, but crude steel output remained at the 2004 level of 8.45mt.

In 2021, Poland imported 4.23mt of steel from outside the EU, up 42% on-year. Much of this came from Russia, Ukraine and Belarus. The Russian invasion of Ukraine therefore spurred panic in the Polish market last month, reflecting in surging prices. This was exacerbated by record-high raw material prices since 2021, and surging electricity costs, Dzienniak added.

The output/consumption gap shows Poland is still dependent on imports and will need to fill the gap left by absent CIS supply following the outbreak of war in Ukraine, said Polish Union of Steel Distributors (PUDS) chief executive Iwona Dybal. The market situation had been normalising following the panic seen in March, but Russia’s decision to cut gas supply to Poland and Bulgaria has now created fresh uncertainty, she added.

Other participants agreed the market has calmed following the initial shock of the Russian invasion. “The ground was cut from under our feet in March,” said Stalprofil ceo Henryk Orczykowski. Mills sometimes cancelled orders, sometimes abruptly raised prices, he added.

Cognor ceo Przemyslaw Sztuczkowski responded by saying there was a small pause in offering but that the firm always honours its contracts. “We have steel to sell, it’s waiting in the warehouse; please order and we will deliver straight away,” he commented.

Adam Smith Germany