Russian mining and steel company Severstal said March 2 it has ceased shipments to the European Union due to the sanctions the bloc imposed on its majority shareholder as a consequence of Russia’s actions in Ukraine.

The company is redirecting commodity flows to alternative markets “due to problems in interaction with European customers,” it said in a statement.

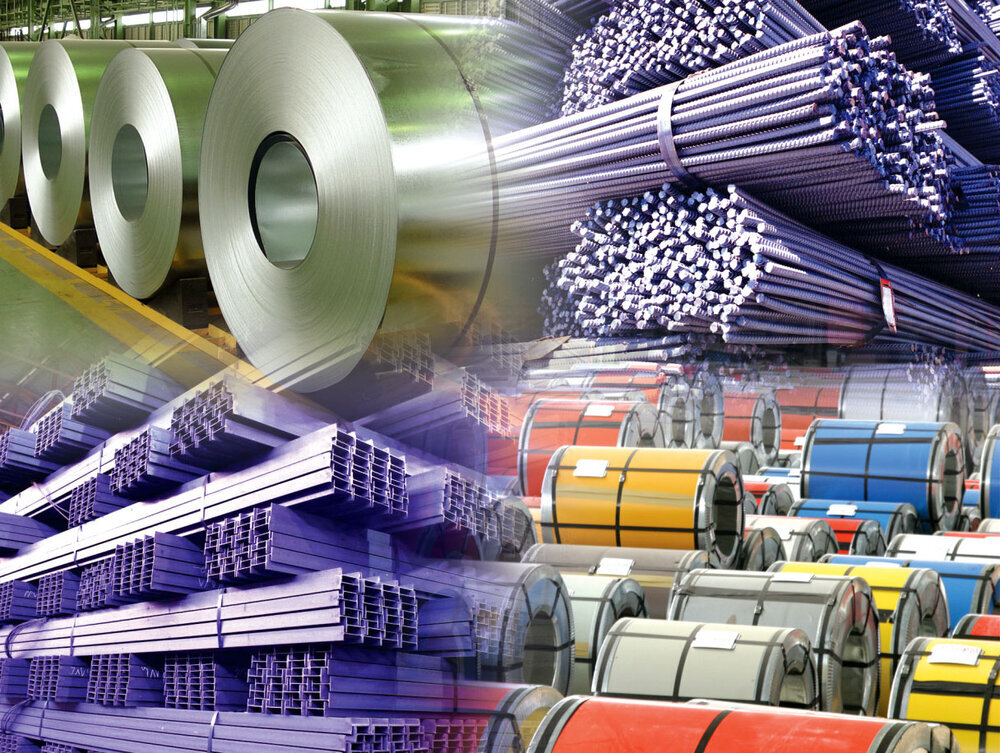

Severstal’s redirection of its commodity flows should help maintain its steelmaking capacity utilization, the company said in a statement, adding its production costs are among the lowest in the world, and this should facilitate redirection of products for sale. It exports mainly flat rolled steel products, and is also a major producer of rebar, metalware, plate and large diameter pipes.

The company’s financial position remains strong and its debt level is low with net debt being 0.23x EBITDA as at the end of 2021.

Last year, Severstal sold 3 million mt of steel to Europe. This represented just over half (57%) of the company’s 5.3 million mt overall exports and just over a quarter (27%) of its total steel sales of 11.1 million mt, according to the company’s 2021 report.

On Feb. 28, the EU imposed restrictive measures against a number of Russian state and public figures and entrepreneurs. These included Alexey Mordashov, a majority shareholder of Severstal, and Alisher Usmanov, the founder of iron ore miner, leading HBI producer and steelmaker Metalloinvest.

On March 1, Metalloinvest said in a statement the sanctions will not affect its operations, as Usmanov owns less than 50% of USM Group – which holds 100% of Metalloinvest – and so does not control the group’s enterprises.

Mordashov holds a controlling, 77%, stake in Severstal and is the chairman of the company’s board. The terms of the sanctions prohibit the EU from dealing with the legal entities under the control of sanctioned individuals.

EU flat steel prices have risen in recent days on concerns that restrictions on material flows from eastern Europe could tighten supplies.

S&P Global Commodity Insights assessed the Platts Northwest European hot-rolled coil March 1 up Eur10/mt at Eur970/mt ($1,1078.25/mt) ex-works Ruhr.

Selective sanctions

Where Russian industrial billionaires are concerned, the EU was selective in imposing personal sanctions. Vladimir Potanin – who through the Interros group holds 34.5% in nickel and palladium producer Nornickel and is the company’s president and chairman of the board – avoided restrictions, as did Vladimir Lisin, chairman of the board of steelmaker NLMK, who through Fletcher Group controls up to 79.3% in NLMK.

“All things being equal, sanctions would have been imposed on all Russian oligarchs, but Europe evaluates each individual case and how sanctions on each of them may backfire,” said a metals and mining industry analyst.

“Nornickel supplies 40% of the world palladium market and imposing sanctions against Potanin would land a strong blow on the EU market, palladium availability and prices. In the case of NLMK, sanctions against Lisin could bring to a halt the mills NLMK has in Europe,” said the analyst.

“As for Severstal, on the one hand, the company has no substantial assets abroad, but at the same time exported (in 2021 just under half of) its production, with sales to Europe representing a large share. On the one hand, sanctions against its majority shareholder hurt the company’s business, but not so much the EU market,” said the analyst.

Some media reports suggest that if Mordashov steps down from the company’s board, which he chairs, this could ward off the impact of the personal sanctions on Severstal.

However, “control (of sanctioned individuals over businesses) can be interpreted quite broadly within the framework of these sanctions, and leaving the company’s governing body might not be enough,” said the analyst.

When in 2018 both Oleg Deripaska and Russian aluminum producer Rusal were sanctioned, with the company sanctioned on the grounds of being under control of the sanctioned businessman, the US agreed to lift sanctions on Rusal only after Deripaska cut his stake in the metals company to below 50%.

Severstal has its steelmaking raw materials and steelmaking and rolling operations in Russia, but has a service centre in Latvia, and several joint ventures with western companies in Russia. These include steel service center Severstal-Gonvarri-Kaluga with Spanish steel processor Gonvarri, Linde Severstal with German industrial gases and engineering company Linde, which produces coil-wound heat exchangers for LNG plants, and wind tower manufacturer Bashni VRS (also known as WRS Towers) that Severstal jointly owns with Spanish renewables company Windar Renovables.

It is unclear whether the western partners will leave these enterprises. However, the Russian government has imposed a ban on foreign investors pulling out of projects in Russia, a representative of Severstal told S&P Global Commodity Insights.

A representative of Linde told Global Commodity Insights that Linde is closely tracking the events unfolding in Ukraine while taking steps to guarantee the safety of its employees and the continuous production and delivery of critical medical oxygen. “The situation is changing rapidly and we are assessing the evolving sanctions framework to ensure full compliance in the context of our existing contractual obligations,” said the representative.

— Ekaterina Bouckley