Betting on the increasing steel demand in Brazil in real estate and infrastructure sectors in the coming years, Mexican steel group Simec announced a plan to double output capacity at its 500,000 mt/year long steel mill plant in Pindamonhangaba, Sao Paulo state.

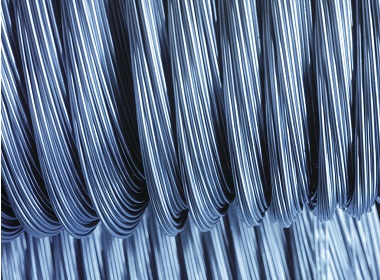

The local Simec subsidiary, named GV do Brasil, has been operating in the country since 2015 and has been producing rebar and rebar coils.

With investments of $300 million, the group plans to install a new electric-arc-furnace and rolling mill.

To feed the new furnace, Simec will also double the capacity to recycle ferrous scrap to 1.25 million mt/year.

At the site of the current mill, there is already advanced infrastructure, such as land, an energy substation, water network and base for new warehouses. This will allow the expansion to be concluded in 28 months instead of 36 months, according to the company. The expansion is slated to kick off in the second half with the new production capacity expected to start up in 2023.

Since last year, Brazilian long steel consumption has grown, driven by the increase in real estate launches, as well as home improvement like renovations and expansions.

In the past 12 months, Brazilian rebar prices have escalated by 153% as local supply remained detached from demand. Year-to-date, prices have risen 48%, according to Platts assessments.

The Simec group reached the third position in the Brazilian long steel market – with about 8% of sales – three years ago, when it acquired two production units from ArcelorMittal: one in Cariacica and another in Itaúna. The sale was a requirement of the Administrative Council for Economic Defense (Cade) to approve the purchase of Votorantim Siderurgia by ArcelorMittal.

With the two acquisitions, Simec now has an annual capacity in Brazil to produce 1.1 million mt of crude steel and 900,000 mt of rolled products – bars, rebars, wire rods and light, medium and heavy profiles.

— Adriana Carvalho