European steel market players on Thursday were still analyzing the possible impact of the European Commission’s proposed definitive safeguard measures on steel imports into the European Union.

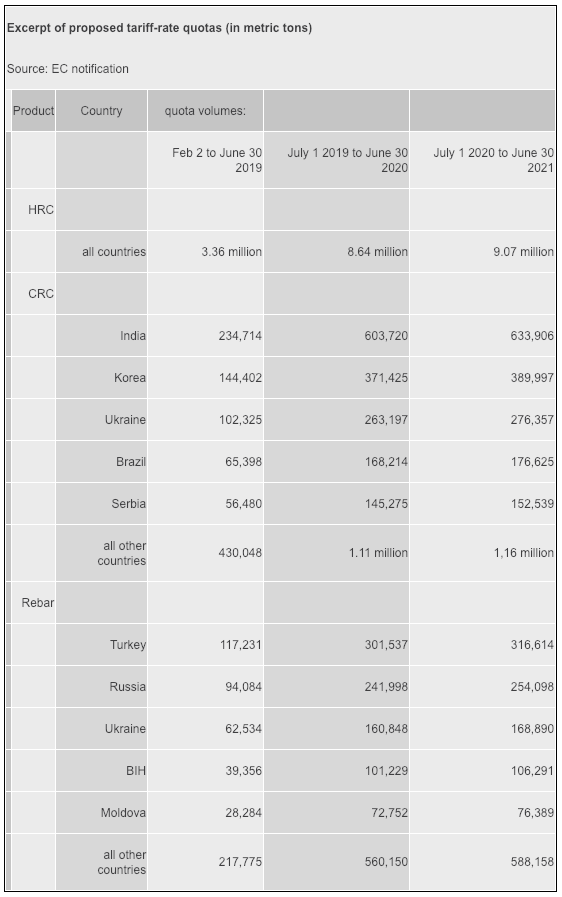

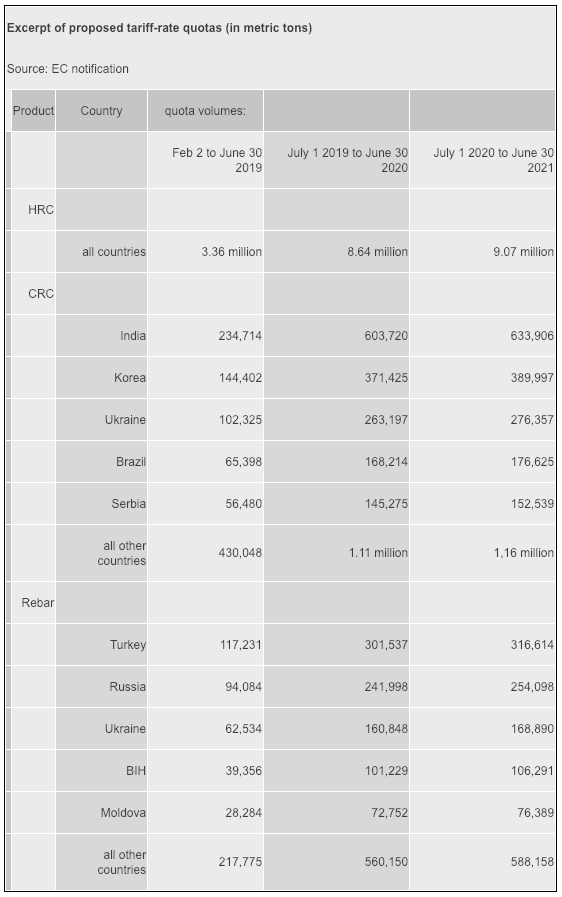

In a notification document to the WTO, obtained by S&P Global Platts, the EC outlined its planned definitive safeguard measures, which include country-specific quotas on the biggest steel-supplying countries to the EU. However, the EC plans to make an exemption for hot-rolled coil imports which would receive a global tariff-rate quota.

The definitive safeguard measures will be enforced no later than February 4, the EC said.

A mill source said it would be “odd” that HRC received a global quota and that Turkey has not been singled out as it was a major source of material for European buyers in 2018.

According to the EC, a country-specific approach would not be appropriate for HRC as 60% of imports are already covered by anti-dumping measures.

Provisional import quotas, which have been in place since July last year, show that HRC quotas have not yet been filled. Around 37% — 1.56 million mt — can still be imported until February 1 out of an initial quota of 4.27 million mt as of the last update on December 28.

“HRC imports weren’t the big problem, there weren’t massive amounts. CRC and HDG were critical,” said the mill source. He added that singling out India for CRC (see table) would be questionable as India has not been a “distorting” supplier in recent years. However, around 604,000 mt (46% of the initial quota of 1.318 million mt) was still available for import and HDG had a balance of 469,000 mt (22% of the initial quota amount of 2.115 million mt) as of late December.

Most market sources consulted told Platts they are still working out what the proposed safeguards would mean.

“It seems there will be some confusion and I think that traders will hold back until it becomes clearer,” UK-based trader said.

He added that he saw large re-rollers being at an advantage with a global tariff-rate quota for HRC because they will be able to bring in large volumes of cheaper HRC and then process it within the EU to value-add the volumes.

Long products saw the most robust import activity in the past few months, with Turkey a major source for importers. It would receive a country-specific quota under the proposal (see table).

The rebar quota balance came to 9,215 mt as of December 31, only 1.35% of the initial allocated amount of 714,964 mt set in July 2018. At 4,384 mt, the wire rod balance is only 0.4% of the 1.6 million mt allocated.

The safeguard measures are intended to be in place for three years — including the period of provisional safeguards that started in July 2018 — expiring July 16, 2021. Once a quota is filled a 25% tariff would apply.

The level of the tariff-rate quota should be increased by 5% in each year the measures are in force. The EC considers that the quantitative level of the tariff-rate quota should be based on the average imports in the period 2015-2017 plus 5%.

When a country with “significant supplying interest” has exhausted its specific tariff-rate quota, it would be allowed to have access to the quarterly global tariff-rate quota for the specific steel product which would apply to all other countries, but only in the last quarter.

Laura Varriale, Len Griffin, Erica Sesay