European Commission investigates extending steel safeguard quotas

The European Commission initiated a review into a possible extension of safeguard quotas on steel imports into the European Union, according to a notification in the Official Journal Feb. 9.

According to the EC, 14 EU member states sent a request to extend the tariff-rate quotas to 2026.

“The request contains sufficient evidence suggesting that the safeguard measure continues to be necessary to prevent or remedy serious injury and that Union producers are adjusting,” the EC said.

As part of the extension investigation, the EC will review the allocation of tariff rate quotas, products as well as categories. The deadline for feedback is Feb. 26.

Market participants mostly welcomed the investigation Feb. 9.

“We need the safeguard extension,” an Italian flat steel service center source said. “Otherwise imports would flood the European market, and the prices would collapse. Neither mills nor distribution need the removal of safeguard.”

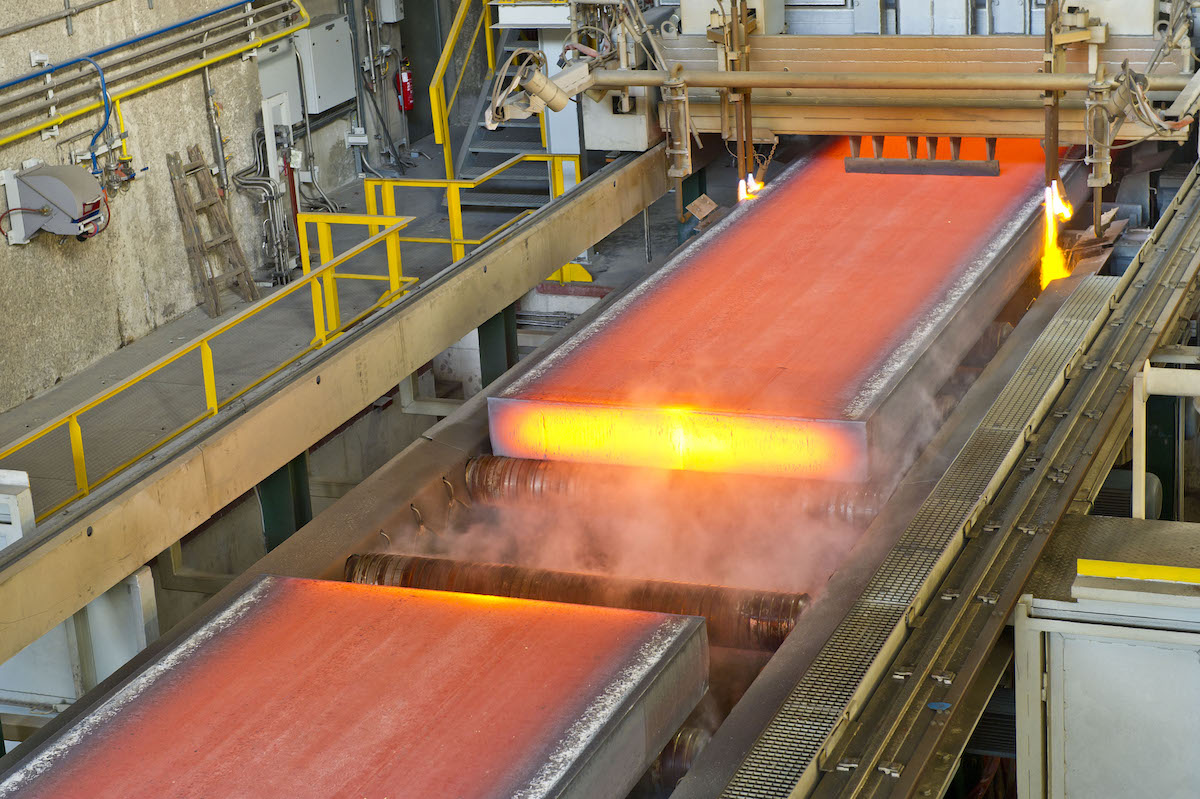

European market participants have been warning of the redirection of trade flows while the US is holding up its section 232 measures on imports as European producers are making costly technical changes at steel plants to decarbonize.

“The mills need the steel prices to remain higher to cover the costs of green transition, and exposure of the European market to import without safeguard would make it more challenging,” a European flat steel mill source said.

One European long steel buyer hoped for an update of specific country quotas.

In the current quota period, running from Jan. 1 to March 31, the hot-rolled coil as well as the wire rod other country quotas were exhausted swiftly after opening Jan. 3. The country-specific quota for hot-dipped galvanized coil for automotive use was also exhausted swiftly. Other steel import quotas remain open as of Feb. 9.

“The safeguard is a legitimate and indispensable tool for stabilizing the EU steel market and ensure the sustainability of the European steel industry, which is on its way to decarbonisation,” Axel Eggert, director general of the European Steel Association, or Eurofer, said Feb. 9.

“Massive, market-disruptive import surges from third countries, mostly with little or no climate ambition, further jeopardize the transition,” Eggert said.

Eurofer particularly warned of excess capacity being directed toward Europe without safeguard quotas, as particularly in Southeast Asia, the Middle East, and North Africa steel production is increasing, while China was close to record steel exports in 2023.

“Consequently, the European Union has become a primary target for trade deflection, with steel exports increasingly redirected towards its market,” Eurofer said.

The UK, which has set up its own steel safeguard quotas, is also investigating extending its safeguards while reviewing a temporary extension of the HRC import restrictions for nine months as Tata Steel UK will idle its two blast furnaces this year and not produce HRC until its electric arc furnace starts 2027.

Authors: Laura Varriale, laura.varriale@spglobal.com, Maria Tanatar, maria.tanatar@spglobal.com, Rabia Arif, rabia.arif@spglobal.com

EU Safeguard Measure is to be reviewed for a possible extension

The European Commission officially announced today that the EU Safeguard Measure is to be reviewed for a possible extension. This is backed by 14 member states who had already requested a review from the EC in January 2024.

The European Commission officially announced today, Friday, February 9, 2024, that the EU Safeguard Measure on certain steel products, which was due to expire in mid-2024, is to be reviewed for a possible extension at the insistence of 14 EU member states.

In addition, the measure is most likely to be extended to the longest possible and WTO-compliant period of 8 years.

US Section 232 tariffs have come to stay

Since the US Section 232 tariffs of the Trump Administration from 2018 are still in force and it is not to be expected that they could be repealed in the foreseeable future, the EC has now also recognized: “…that there are no elements suggesting that the US will be removing the Section 232 measures on steel”.

The introduction of the US punitive tariffs triggered a backlash from the European Union and led to the existing EU Safeguard Measures against steel imports to Europe in 2019.

German steel regions had called for EU Safeguard extension

Last Wednesday, we reported on the German steel regions’ call for the German government in Berlin to support a continuation of the Safeguard measure and that it is therefore only a matter of time before the EC takes action.

Source: steelnews.biz