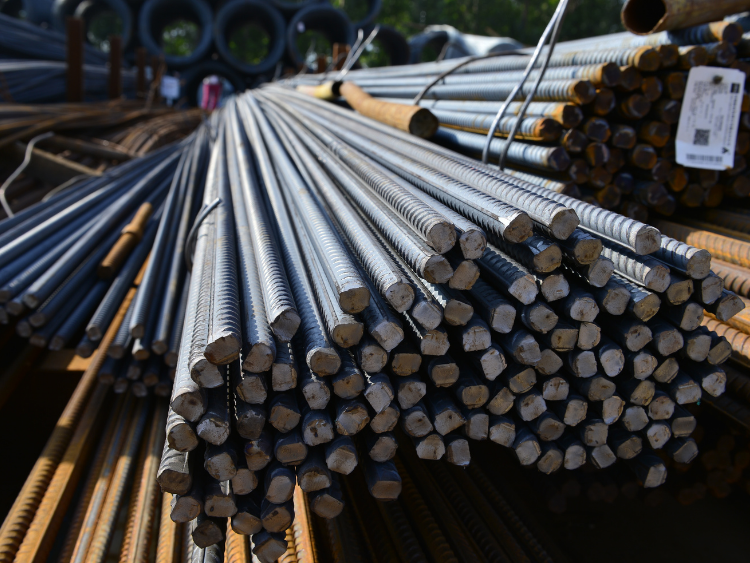

Italian mills cut rebar prices again

Italian longs producers cut prices this week, amid the weak construction season and tepid global market recovery.

Argus‘ weekly Italian rebar assessments declined by €15/t to €575/t ex-works, while the drawing-quality wire rod index softened by €10/t, to €650/t delivered.

Italian producers dropped rebar prices to €580/t ex-works, including extras for sizes, with levels of €560-570/t ex-works available for larger orders, probably in attempts to spur buying interest ahead of the Easter holiday. Demand remains low as customers still doubt prices have reached the bottom, market participants said.

Indications for Italian drawing quality wire rod stood in a wide range of €640-670/t delivered locally and to nearby markets depending on tonnages, but producers were yet to start offering April material. In Spain offers were €10/t below these levels last week, but given high pressure from imports it was possible to obtain lower prices for sizable tonnages in Italy and Spain. Workable levels for high-carbon wire rod remained at €750-780/t delivered in Italy late last week.

Offers to nearby markets were scarce as some mills closed their March order books and were about to start their April campaign next week. But indications for rebar were pegged at €585-590/t ex-works, although given lower local prices discounts were deemed available. Despite a slow recovery seen in the construction sector across Europe, Italian mills were mainly focused on the central region while they faced high competition with Turkish suppliers in the southern countries.

Although inflation rates fell below 3pc, it was unclear if interest rates might decrease, but any cut would only be slight, a German market participant said. Construction activity is not expected to improve substantially, with fabricators maintaining cut and rebar prices in the range of €650-690/t delivered in Germany. Rebar prices from Germany mills were indicated at €640-650/t delivered for smaller tonnages and at least €630-640/t delivered lower for larger lots, with €620/t delivered available in some cases. Some German buyers were still receiving tonnages booked late last year for the first quarter as they had to postpone these deliveries after slower than expected construction demand.

In Poland rebar prices fell to €650/t delivered and below locally, with €630/t delivered available to nearby markets last week.

Offers of Bulgarian rebar lowered to 1,215-1,230 lev/t (€621-629/t) delivered last week under pressure from cheaper imports.

Some European buyers have resumed purchases of rebar and wire rod from overseas suppliers in recent weeks, suggesting prices may be close to reaching a floor. Sales were reported mainly from Turkey to Balkan markets at $580-595/t for small lots of rebar, with latest bookings heard to Serbia and Albania last week. “In Serbia no-one wants to buy a kilogram, as they are scared of further price drops,” a buyer said. Drawing quality wire rod was also heard booked from Turkey mainly to Spain at €590/t cfr or slightly below for late March-early April shipment in the past two weeks, with this quarter’s quota filled and it is estimated that Turkish allocation for the next quota period will be exhausted promptly in the first few days of next month.

Egyptian mills were offering rebar at $580-590/t fob and were said to be focusing on other markets, such as the Americas. There was talk that GCC rebar might have been imported to Europe recently, probably because of a prolonged downturn in Asia and other markets, but no details have emerged.

Argus Media

CBAM complications, safeguard hinder steel activity: Assofermet

The normative framework of the EU Carbon Border Adjustment Mechanism (CBAM) and safeguards on steel imports is hindering the daily activity of Italian and European steel companies, says Italian steel trade association Assofermet.

The challenges in filling CBAM reports, the economic repercussions expected from the mechanism starting in 2026, as well the safeguard measures in force from 2018 are a deep concern for Assofermet’s many members.

The European Commission (EC)’s Directorate General for Trade and the Directorate General for Taxation and Customs Union asked the association to highlight the critical issues of the mechanism to help with drafting the final version. “It has been assured that our perspective will be taken into account, especially for the future evolution of CBAM … Agreeing that CBAM will also generate increased costs for downstream end-users in the steel supply chain, it was pointed out to the Commission that if certain finished products … are not included in the mechanism, the European industry will lose competitiveness, given its global role,” Assofermet warns in a note sent to Kallanish.

The association notes an open-minded attitude from Italian authorities to listen to the problems of the entire steel supply chain stemming from regulations and willingness to continue dialogue on the regulatory framework. While the first quarterly report deadline for CBAM has passed, the safeguard on steel imports is currently set to expire at the end of June 2024. “There are no official updates yet on a possible extension after the first half of this year,” Assofermet concludes.

31 January was the deadline for importers to submit their first report detailing emissions as part of CBAM. The European Commission nevertheless announced this week that due to a technical incident, it is offering the possibility to request for a 30-day delay for submission (see Kallanish passim).

During the ongoing transitional phase of CBAM, European importers of steel need to file quarterly reports in the European Commission system, starting from those for the fourth quarter of 2023. During the transitional period, importers are required to report on the quantity of imported goods and resulting direct and indirect emissions. No payments will be due. The transitional phase is planned to conclude at the end of 2025.

Natalia Capra France

Italian stainless coil orders pick up

Italian stainless steel coil prices are increasing after values reached rock bottom in July. European producers are hiking by approximately €100/tonne ($109) and contracted prices are seen rising accordingly in September for hot and cold rolled coil for October delivery, sources tell Kallanish.

Much of the market is now on holiday in Italy and in other European countries. Italian mills’ order intake improved in July and the first days of August. This follows a long period of quiet activity and contracting orders. Local service centres have bought some volumes for July, August and September delivery, while some deliveries are being delayed due to the August production stoppages.

At present, asking prices for October-delivery stainless CRC in Italy are at €2,300-2,350/t delivered on average, and some €150/t less for HRC. CRC with trimmed edges is transacting at about €2,200/t delivered, with HRC at about €2,000-2,050/t delivered, sources suggest.

Two Italian buyers say prices will have to increase for coils and derivatives in September but volumes will remain limited. Service centres’ clients are reported to have some work, but their activity remains low. Purchases in September should surge for October deliveries, owing to market seasonality. At present, however, distributors are reporting a low level of orders and a continuing wait-and-see attitude.

Natalia Capra France

Italian September tube may hike on costlier HRC

Italian welded tube prices are seen increasing in September, in line with the expected increases in coil values. The welded tube market remains subdued, with demand weak and prices depressed in most European countries, sellers and buyers tell Kallanish.

Tube values continue to lag behind hot rolled coil tags due to weak downstream demand. Uncertainty is dominating the market, which is now quiet due to the August holiday break. Discounts remain at 37-39 points, with purchases implemented only back-to-back and prices unsustainable compared to processing costs.

Commodity grade 40x40x3 product remains at €800/tonne ex-works, which provides practically no margin. While some positive signals are coming from the automotive sector, many other industries are ordering low volumes and distributors are keeping stocks low. Tube sales in July and the first week of August are reported to be weak with no significant restocking occurring.

The Italian and European HRC market is however forecast to become livelier in September and prices to increase, pushed up by the exhaustion of EU import quotas. Third-quarter quotas from Vietnam, Indonesia and other Asian countries are already exhausted, while few tonnages remain from Korea. Buyers can import only from Turkey, whose suppliers are offering higher prices, as well as from India.

HRC buyers say Korean suppliers will give no allocations to Italy for Q4 and new import quotas will expire on 1 October, the same day as they are renewed. Amid the general downturn of the steel sector in Europe, this seems the only good news for September, and both coil and coil derivative prices are seen increasing, albeit gradually. The market remains fragile. Downstream demand and consumer confidence are seen remaining weak, with no surprises until the end of the year.

The target for re-rollers is to reach 35 points for tube discounts. Sources see September HRC prices at €700/t ($766) base ex-works.

Natalia Capra France